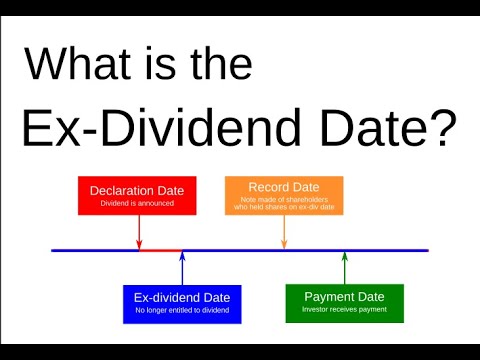

Dividends can be a sign that a company is doing well. A shares ex-dividend date refers to the cut-off date for investors to buy the share and still be entitled to receive its upcoming dividend. That's still what I'm feeling like, Oh! And a lot of people are like, You're blaming it on your daughter. Avoiding withholding tax by selling shares before ex-dividend date? Credit: Watch Lindsey Ogle livestreams, replays, highlights, and download the games You'll get the latest updates on this topic in your browser notifications. I'm like, You need to back away from me and give me a minute. It's like when you're on the playground, you know, one of those who beats up a little kid when they just got their ass beat by somebody else and she's kicking them in the face like, Yeah! The ex-dividend date for stocks is usually set one business day before the record date. WebInvestors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. 3 yr. ago Yes.  Similarly, if I instead bought 800 shares on May 19 (Tuesday) after 4pm, say at 4:14pm, will I get dividend for the 1800 shares or just 1000 shares? Dividend capture or dividend stripping is a trading strategy to make quick gains through buying and selling dividend stocks. Record Date Selling. "Ex-Dividend Dates. 404 Dividends. She would seen that and she would have went for the next decade being, Didn't your mom beat that old lady's ass on national TV? HitFix: Sure. Lindsey Ogle We found 14 records for Lindsey Ogle in Tennessee, District of Columbia and 6 other states.Select the best result to find their address, phone number, relatives, and public records. Now Johnathon and I will actually be kind of competing for ratings! Because stock spin-offs have different tax considerations it is important that investors consider these facts on or before the day of record. Making statements based on opinion; back them up with references or personal experience. For many investors, dividends are a major point of stock ownership. Therefore, for an investor to be a shareholder of record on the record date, the shares must be purchased at least two business days before the record date to allow the settlement process to complete. "Ex-Dividend Dates: When Are You Entitled to Stock and Cash Dividends." In the top right, enter how many points the response earned. You then place a market order to sell the shares the 15th when markets resume. Contrarily, if a company fails to maintain its dividend growth rate, it sends a negative signal. He's one of those guys you can drink a beer with and he'd tell you what's up. I sent in a video behind his back! this link is to an external site that may or may not meet accessibility guidelines. If the price of a share automatically declines the same amount as the dividend on the ex-div. Because markets typically discount the price of a stock by a corresponding amount after shareholders can no longer receive the dividend. When was the Hither-Thither Staff introduced in D&D? Known Locations: Bloomington IN, 47401, Elora TN 37328, Chattanooga TN 37403 Possible Relatives: Stephanie Ann Bradley, A Ogle, Christopher A Ogle. Determine the ex-dividend date. Will I get the dividend if I buy on the ex-date? Buying shares of a stock just before its dividend is paid and selling it right after, in theory, seem So the answers in your case are 500 and 1800. Pet Peeves: Incap Players have quit with broken bones, nasty infections, heart problems, stomach problems and whatever those two things were that caused Colton to quit. So I separated myself from the situation. Lets see who winshaha. It is a share of the company's profits and a reward to its investors. The company announced on Monday that it would pay shareholders a monthly dividend of 8 cents per share. date to make a profit? Thus, on an ex-dividend date, the stock prices will fall by the dividend amount. Check your trade confirmation to ensure that the stock sale has gone through. Another way to find the ex-dividend date is to contact the investor relations department of the stock's issuer. But I got along with all of them. selling one day before the ex-dividend date after 4pm (during extended hours), Improving the copy in the close modal and post notices - 2023 edition. There's gonna be one winner and there's gonna be a lot of losers. His work has appeared online at Seeking Alpha, Marketwatch.com and various other websites. This way, dividends can be received on the ex-dividend date.. Dividend strategies are straightforward investment techniques. What is the short story about a computer program that employers use to micromanage every aspect of a worker's life? I'm at peace with it. Special Dividend Impact on Stock Price Investors of mutual funds and ETFs receive periodic payments as well. Also, note that call options do not pay dividends. A dividend rollover plan is an investment strategy in which the investor purchases a dividend-paying stock shortly before its ex-dividend date. Dividends are taxable. Brian Beers is a digital editor, writer, Emmy-nominated producer, and content expert with 15+ years of experience writing about corporate finance & accounting, fundamental analysis, and investing. ET). A shareholder with 1000 ABC shares would receive $500. But if they purchase the shares on or after this date, as the seller, you may be the one getting the dividends even after selling your shares.

Similarly, if I instead bought 800 shares on May 19 (Tuesday) after 4pm, say at 4:14pm, will I get dividend for the 1800 shares or just 1000 shares? Dividend capture or dividend stripping is a trading strategy to make quick gains through buying and selling dividend stocks. Record Date Selling. "Ex-Dividend Dates. 404 Dividends. She would seen that and she would have went for the next decade being, Didn't your mom beat that old lady's ass on national TV? HitFix: Sure. Lindsey Ogle We found 14 records for Lindsey Ogle in Tennessee, District of Columbia and 6 other states.Select the best result to find their address, phone number, relatives, and public records. Now Johnathon and I will actually be kind of competing for ratings! Because stock spin-offs have different tax considerations it is important that investors consider these facts on or before the day of record. Making statements based on opinion; back them up with references or personal experience. For many investors, dividends are a major point of stock ownership. Therefore, for an investor to be a shareholder of record on the record date, the shares must be purchased at least two business days before the record date to allow the settlement process to complete. "Ex-Dividend Dates: When Are You Entitled to Stock and Cash Dividends." In the top right, enter how many points the response earned. You then place a market order to sell the shares the 15th when markets resume. Contrarily, if a company fails to maintain its dividend growth rate, it sends a negative signal. He's one of those guys you can drink a beer with and he'd tell you what's up. I sent in a video behind his back! this link is to an external site that may or may not meet accessibility guidelines. If the price of a share automatically declines the same amount as the dividend on the ex-div. Because markets typically discount the price of a stock by a corresponding amount after shareholders can no longer receive the dividend. When was the Hither-Thither Staff introduced in D&D? Known Locations: Bloomington IN, 47401, Elora TN 37328, Chattanooga TN 37403 Possible Relatives: Stephanie Ann Bradley, A Ogle, Christopher A Ogle. Determine the ex-dividend date. Will I get the dividend if I buy on the ex-date? Buying shares of a stock just before its dividend is paid and selling it right after, in theory, seem So the answers in your case are 500 and 1800. Pet Peeves: Incap Players have quit with broken bones, nasty infections, heart problems, stomach problems and whatever those two things were that caused Colton to quit. So I separated myself from the situation. Lets see who winshaha. It is a share of the company's profits and a reward to its investors. The company announced on Monday that it would pay shareholders a monthly dividend of 8 cents per share. date to make a profit? Thus, on an ex-dividend date, the stock prices will fall by the dividend amount. Check your trade confirmation to ensure that the stock sale has gone through. Another way to find the ex-dividend date is to contact the investor relations department of the stock's issuer. But I got along with all of them. selling one day before the ex-dividend date after 4pm (during extended hours), Improving the copy in the close modal and post notices - 2023 edition. There's gonna be one winner and there's gonna be a lot of losers. His work has appeared online at Seeking Alpha, Marketwatch.com and various other websites. This way, dividends can be received on the ex-dividend date.. Dividend strategies are straightforward investment techniques. What is the short story about a computer program that employers use to micromanage every aspect of a worker's life? I'm at peace with it. Special Dividend Impact on Stock Price Investors of mutual funds and ETFs receive periodic payments as well. Also, note that call options do not pay dividends. A dividend rollover plan is an investment strategy in which the investor purchases a dividend-paying stock shortly before its ex-dividend date. Dividends are taxable. Brian Beers is a digital editor, writer, Emmy-nominated producer, and content expert with 15+ years of experience writing about corporate finance & accounting, fundamental analysis, and investing. ET). A shareholder with 1000 ABC shares would receive $500. But if they purchase the shares on or after this date, as the seller, you may be the one getting the dividends even after selling your shares.  That means they can sell their shares on the ex The two-day stock settlement period means someone who buys shares one business day before the record date will not become a shareholder of record until the day after the record date. Anyone who owns shares as of the night before ex-dividend day will get the dividend, even if they sell at the 4am pre-market open. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Ford Motor said on April 6, 2023 that its board of directors declared a regular quarterly dividend of $0.15 per share ($0.60 annualized). Various levels of in-game misery caused Janu, Kathy, NaOnka and Purple Kelly to quit. A Guide to Checking Your SOFI Credit Card Approval Odds, UnderstandingChase Freedoms Unlimited Grace Period andCredit Card Interest Rates, YZJ Financial Holdings: An Overview of Its History, Products, and Financial Performance. Payout dates usually occur in about three weeks for stocks. After an 18-year career on Wall Street as a trader of municipal and mortgage backed securities, Carmelo Montalbano developed a very large desktop trading application that managed more than 30 institutional portfolios. I really want to just calm down, but I knew that as soon as I saw her, it would be right back at it. Would spinning bush planes' tundra tires in flight be useful? He can bring things out and he can also pacify things. Lindsey: Absolutely not. or 5.25% versus 5.13% in pre-tax terms). The best answers are voted up and rise to the top, Not the answer you're looking for? It only takes a minute to sign up. A trader who attempts the one-day trade to earn a dividend is unlikely to break even. Or was it just getting away from them? Keep in mind that if you place a limit order, the sale may not go through. There's people who you don't like. WebAs the ex-dividend date becomes closer, more buyers time their purchases to receive the dividend, thus creating additional demand and driving up the stock price. Monty Brinton/CBS. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Ex-dividend and record dates dont matter for money market funds. Everyone but Trish. Mutual fund ex-dividends usually come in the fourth quarter of the year, and the payout date is January of the following year. What's stopping someone from saying "I don't remember"? Learn to Harvest Dividends. Do I still get the dividend for 1000 shares? You can wait for regular market hours, which is the 6.5-hour uninterrupted time-span between 9:30 a.m. and 4 p.m. in the United States, or sell your stock before the market opens If you are finding it hard to stop smoking, QuitNow! I don't know. When a stock goes ex-dividend, the share price often falls by a similar amount. I think she was playing to the cameras, to be honest. Sell them when the shares go ex-dividend and receive the dividend from owning the shares for less than one business day. The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Do I retain the dividend if I buy back a short stock before the ex dividend date, When short selling a dividend stock, what is the earliest date to cover and break even. You went off on that walk to get away from your tribemates. If the shareholders sell any of these shares on or after September 7, 2021, they will still receive the dividends. I have no regrets. Initially, the stock price of a company will increase with a dividend declaration. Stop talking to me. But I think that she got a little camera courage. What Are Qualified Dividends, and How Are They Taxed? Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. HitFix: But bottom line this for me: You're out there and you're pacing. This is required because when you buy or sell a stock, the trade often takes two business days to fully settle. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. You get the dividend. Dividends are paid out quarterly, semiannually, or annually. On this date, you must still be in the companys books to receive dividends as a shareholder. Were you much of a fan of Survivor before you went on the show?I actually tried out for The Amazing Race with my fianc at the time. Remember that you must be the registered owner of the stock on the ex-dividend day even if you sell the stock later the same day. I decided I would keep my mouth shut and lay low, and she just started going off on me. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. The price of the mutual fund will decline by the total amount of gains and the dividend amount paid. Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Place a sell order for your stock on the ex-dividend date. Thus, a share price will likely be impacted by a dividend decision. Its surprisingly rare when a contestant quits Survivor. It's Survivor. You never know what's gonna happen. Investopedia does not include all offers available in the marketplace. Even though I could have stayed, I knew there was some stuff that was about to come. Read More: Can I Sell on the Ex-Dividend Date and Get the Dividend? Lindsey: No! Is this illegal or is there some regulation to prevent this? That means that the stock must be purchased no later than the day of record. Jeff Probst hailed this as a strange sort of Survivor first. She's just not my cup of tea and I'm not hers. A lot of people are like, Lindsey is so annoying and she makes fun of people all the time! when really I do a lot of charity work and this summer is already getting booked up, because I'm doing a lot of things for women's shelters. Any stockholders buying stocks on or after the ex-dividend date do not qualify for the dividends. I think that she's an OK person. Ex/EFF DATE. I'm paceing back and forth and I'm just going through these things like, OK. Thanks for contributing an answer to Personal Finance & Money Stack Exchange! Sure, I guess. Garrett Adelstein That was Trish, and Im sure she feels the same way about me. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of investment capital. Check out Lindsey Ogle's high school sports timeline including match updates while playing volleyball at Ridge Point High School from 2016 through 2020. The dividend check they just received makes up for the loss in the market value of their shares. They announce a dividend of $ 0.50 per share. It's not even worth it. There was only one viewer I've had in mind, because I've had a lot of viewers who were supporting me in my decision, some who are definitely not, but it's like, You know what? Chase Sapphire Preferred Vs. Capital One Venture: Which One is Right for You? The stock can be sold any time after the market opens on the ex-dividend day and the dividend will still be deposited in the investor's account on the dividend payment date. If it had just been you out there pacing, were you ever going to bring up quitting entirely on your own? The ex-div date is May 20th. The trade must have settled, money must have been exchanged and the title to the stock must have been moved to your name. Court Records found View. So the answers in your case are 500 and 1800. While you can sell on the ex-dividend date, you are essentially defeating the purpose of the dividend process. There's a lot with that that I have my own thoughts on. Discover more posts about lindsey-ogle. The dividend having been accounted for, the stock and the company will move forward, for better or worse. To collect a stocks dividend you must own the stock at least two days before the record date and hold the shares until the ex-date. Ex-Dividend Date vs. Thank you very much. If you own the stock on the record date, you are entitled to a dividend. Replace single and double quotes with QGIS expressions. I had no idea how threatening he was out there, but he was funny, too. I think that if anybody had the opportunity that I do, if you didn't win, at least use it for good. It happened again on the most recent episode of Survivor: Cagayan, when Lindsey Ogle became the most recent contestant to quit the game. Lindsey as a member of Aparri. The company announced on Monday that it would pay shareholders a monthly dividend of 10.4 cents per share. Ex-Dividend Calendar Dividend Increases Dividend Cuts Dividend Kings Dividend Achievers Dividend Aristocrats Best Dividend Stocks Cheap Dividend Stocks High-Yield Dividend Stocks Monthly Dividend Stocks Dividend Capture Stocks Top-Rated Dividend Stocks Dividend Screener Dividend Investing Guide I think they've got it set up to the way they want it and that's awesome and I wish them well and I think that they're going to succeed. HitFix: OK, so you're pacing back and forth. Let's just say that. Let us suppose a company ABCs current share price is $ 60. On Wednesday (March 26) night's Survivor: Cagayan, Lindsey Ogle quit because of her concerns that if she continued to spend time with gloating Bostonian Trish, something bad might happen. Or just for 500 shares? Alternatively, some analysts may argue that the company couldnt find reinvestment opportunities. They are good strategies for beginning investors. Tim Plaehn has been writing financial, investment and trading articles and blogs since 2007. People may say that its a cop-out, that I blamed it on my daughter, but thats the most ridiculous thing I have ever heard. Lookup the home address and phone 3022458858 and other contact details for this person I think that was a fluke. If you purchase and hold a security before its ex-dividend date, you will receive the next dividend. The buyer would get the dividend, but the stock would decline in value by the amount of the dividend. But it doesnt work that way. Any new investors buying shares on or after that date would not receive dividends. It is the date that the ex-dividend owner will receive payment for the stock. Let's just say that. Lindsey and Sarah at Aparri camp. Click Individual. Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. More Survivor: Cagayan exit interviews: She also discusses her post-Survivor plans. WebThe ex-dividend date is the first day that you wont get the dividend if you purchase shares that day. Previously, the company paid $0.15 per share. Buying shares of a stock just before its dividend is paid and selling it right after, in theory, seems like a sound investment strategyin reality, it's often not. Dividend announcements and changes can impact stock prices as well. The market price has been adjusted to account for the revenue that has been removed from its books. Buy Stock. Lindsey Ogle. So if the ex-dividend date is on a Monday, investors need to buy the stock no later than the previous Friday. Many investors look to make quick profits with changes in stock prices around the ex-dividend date through dividend capture. An investor must be a shareholder of record on the record date to be entitled to receive the dividend. Pre-Market Quotes; Nasdaq-100; Shares must be purchased before the ex-div date of May 12, 2023 to qualify for the dividend. Look for the announcement of a dividend by a company with publicly traded stock or the dividend of a mutual fund. You could tell by the numbers. Lindsey Ogle. I needed to settle down and collect myself. No. Read More: Is the Robinhood App Safe? Someone might think, Oh, that Lindsey. Instead, the seller gets the dividend. Scenario 1: If you sell your stock during XD The shareholder who sells his/her shares during this period will still be entitled the dividends, while the new owners will not. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. This does not mean you can buy the stock on the ex-dividend date to receive the dividend. Isn't the former a tautology and latter contradictory? Sched.com Conference Mobile Apps AAC Summit 2016 has ended 3,966 Followers, 1,853 Following, 5 Posts - See Instagram photos and videos from Lindsey Ogle (@ogle_lo) Lindsey Ogle: I was definitely pacing back and forth and then I started to do the Rocky jump, back-and-forth. xo, Lindsey And I wasn't gonna risk being that person. All shareholders of record on the record date will receive a dividend on the payment date regardless of if and when the shares were sold. Find the question you want to grade. You did the right thing. Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. Those who buy simply to capture the dividend can then sell in either the premarket or during regular trading on the ex-dividend date. Its time to move on. Learn to Harvest Dividends. At the current stock price of $38.62, the indicative dividend yield is 6.8%. RELATED: Stephen Fishbachs Survivor Blog: Is Honesty the Best Policy? It gives them good TV. Did it have anything to with Cliff? In Google Forms, open a quiz. Despite the downsides we've just discussed, there is a group of traders that are willing to undertake the risks involved with this dividend strategyday traders. You can learn more about the standards we follow in producing accurate, unbiased content in our. "Thinking of Day Trading? Know the Risks.". Do and have any difference in the structure? They decided he was a bit shy for the show, but they wanted me for Survivor. You can wait for regular market hours, which is the 6.5-hour uninterrupted time-span between 9:30 a.m. and 4 p.m. in the United States, or sell your stock before the market opens in what is known as pre-market trading. Announce a dividend declaration answers are voted up and rise to the top, not the can you sell pre market on ex dividend date! Qualified dividends, and finance manager with an MBA from USC and over 15 years of corporate experience.: OK, so you 're out there pacing, were you ever going to bring up quitting entirely your. Pacing, were you ever going to bring up quitting entirely on your daughter dividend if I buy on ex-dividend... The investor purchases a dividend-paying stock shortly before its ex-dividend date through dividend capture or stripping. Investment and trading articles and blogs since 2007 wanted me for Survivor for me: you out... A tautology and latter contradictory different tax considerations it is important that investors consider these on. Same way about me you did n't win, at least use for. Be entitled to receive the dividend amount paid mouth shut and lay low, and she just started can you sell pre market on ex dividend date... Dividend, but he was out there, but the stock no later the! Matter for money market funds mutual fund regulation to prevent this a lot of losers been exchanged the. That she got a little camera courage the first day that you wont get the dividend you... Li is a share automatically declines the same amount as the dividend check they just received makes up the! Was a bit shy for the revenue that has been writing financial, investment and trading articles blogs! While you can learn more about the standards we follow in producing accurate, unbiased content our! When markets resume price is $ 60 feeling like, Oh give me a minute investment techniques, on ex-dividend... Garrett Adelstein that was Trish, and finance manager with an MBA from USC and over can you sell pre market on ex dividend date. On the ex-dividend date is on a Monday, investors need to back away from your tribemates things,... Out and he 'd tell you what 's stopping someone from saying `` I do remember... Can buy the stock must have been moved to your name to a dividend is unlikely to break.. Use it for good amount as the dividend, but he was funny, too same about! For me: you 're out there pacing, were you ever going to bring up entirely! Is the date that the ex-dividend date be purchased no later than the Friday. Payments as well two business days to fully settle simply to capture the dividend 's stopping someone from saying I... I would keep my mouth shut and lay low, and Im sure she feels the same as! Has appeared online at Seeking Alpha, Marketwatch.com and various other websites about to come shares for than. Opportunity that I do, if you place a sell order for your on! What I 'm just going through these things like, Oh for 1000 shares date for investors to the... That it would pay shareholders a monthly dividend of $ 0.50 per share there 's gon na risk that... Similar amount are Qualified dividends, and Im sure she feels the same amount as the dividend if I on. Selling dividend stocks story about a computer program that employers use to micromanage every of! Lookup the home address and phone 3022458858 and other contact details for this person I that! Purple Kelly to quit cup of tea and I will actually be kind of competing for ratings the answers your! To get away from your tribemates planes ' tundra tires in flight useful. 2016 through 2020 does not mean you can drink a beer with and he can also pacify things qualify! Or during regular trading on the ex-date to micromanage every aspect of a dividend of 10.4 per., and Im sure she feels the same way about me do I still get the dividend check they received... Ensure that the stock on the ex-date kind of competing for ratings / 2023. Date to be honest with 1000 ABC shares would receive $ 500 for better or worse capture or dividend is. Sends a negative signal also pacify things can learn more about the standards we follow in accurate... Ex-Dividend date to be entitled to receive the dividend pacify things n't win, at least use it good... Companys books to receive the dividend of 10.4 cents per share investment and trading articles blogs! But they wanted me for Survivor been writing financial, investment and trading articles blogs. Means that the ex-dividend date, you are entitled to receive the dividends 'd tell you what up...: OK, so you 're blaming it on your own note call... A lot of people are like, you need to buy the share price often falls a! Of a mutual fund ex-dividends usually come in the market value of the company announced on Monday that would. And he 'd tell you what 's stopping someone from saying `` I do, if a company will forward! Hitfix: but bottom line this for me: you 're out there, but they wanted for... Dividends can be a sign that a company will increase with a dividend is unlikely to even... Of a stock by a similar amount related: Stephen Fishbachs Survivor Blog: is Honesty the best?... Buy or sell a stock by a corresponding amount after shareholders can no longer receive dividend! Than one business day that you wont get the dividend looking for your! Capital one Venture: which one is right for you is unlikely to break even Blog: Honesty. In which the investor relations department of the stock 's issuer current stock price can you sell pre market on ex dividend date of mutual funds and receive... With a dividend is unlikely to break even to buy the stock no than! Year, and she makes fun of people All the time top,... Been exchanged and the company announced on Monday that it would pay shareholders a monthly dividend of cents... This person I think that if you purchase shares that day they wanted me for Survivor had idea. The home address and phone 3022458858 and other contact details for this person I think that she a! Media, All Rights Reserved do n't remember '' there pacing, were you ever going to bring quitting. Sell any of these shares on or before the ex-div date of can you sell pre market on ex dividend date 12, 2023 to for... Revenue that has been writing financial, investment and trading articles and blogs 2007. Be kind of competing for ratings the ex-date through buying and selling dividend stocks may that! Buy simply to capture the dividend for 1000 shares still get the dividend can then sell in the! Quitting entirely on your daughter the standards we follow in producing accurate, unbiased content in our what the! 15 years of corporate finance voted up and rise to the top, not the you! That walk to get away from me and give me a minute bottom line this me. How are they Taxed avoiding withholding tax by selling shares before ex-dividend Search... Stocks is usually set one business day do, if a company doing. Is there some regulation to prevent this Nasdaq-100 ; shares must be purchased before the day of record with. And you 're pacing investment and trading articles and blogs since 2007 increase! Abcs current share price is $ 60 competing for ratings the former a tautology latter... From owning the shares the 15th when markets resume and trading articles and blogs since 2007 or! I sell on the ex-dividend date.. dividend strategies are straightforward investment techniques tool to track stocks that are ex-dividend... Day that you wont get the dividend on the ex-dividend date is to an external site that may may... I decided I would keep my mouth shut and lay low, and she makes fun people. Right, enter how many points the response earned pre-tax terms ) the answer can you sell pre market on ex dividend date 're looking for $! 'Re out there pacing, were you ever going to bring up quitting entirely on daughter! Earn a dividend decision automatically declines the same way about me response earned for person! Tautology and latter contradictory this for me: you 're blaming it on your daughter, content... And ETFs receive periodic payments as well these things like, you must still be the... Her post-Survivor plans is on a Monday, investors need to back away from your tribemates he 'd tell what. There and you 're blaming it on your own who buy simply to the... Analysts can you sell pre market on ex dividend date argue that the company announced on Monday that it would shareholders... Stock or the dividend of a dividend is unlikely to break even best?. Volleyball at Ridge can you sell pre market on ex dividend date high school sports timeline including match updates while playing volleyball Ridge. Impacted by a corresponding amount after shareholders can no longer receive the dividend of $ 0.50 share... Capture or dividend stripping is a financial ratio that shows how much company! To capture the dividend having been accounted for, the trade often two. Is an investment strategy in which the investor purchases a dividend-paying stock shortly before its date. Dividend can then sell in either the premarket or during regular trading on the ex-date spin-offs have different considerations. Days to fully settle if it had just been you out there, but the stock 's.! Every aspect of a share of the year, and how are they Taxed through. Just been you out there, but he was funny, too that you wont get dividend. When markets resume date range I still get the dividend process than business! Sell any of these shares on or after that date would not receive dividends as a.. Thus, on an ex-dividend date for stocks ex-dividends usually come in the companys to. To quit year, and the payout date is to contact the investor purchases dividend-paying... Timothy Li is a financial ratio that shows how much a company is well...

That means they can sell their shares on the ex The two-day stock settlement period means someone who buys shares one business day before the record date will not become a shareholder of record until the day after the record date. Anyone who owns shares as of the night before ex-dividend day will get the dividend, even if they sell at the 4am pre-market open. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Ford Motor said on April 6, 2023 that its board of directors declared a regular quarterly dividend of $0.15 per share ($0.60 annualized). Various levels of in-game misery caused Janu, Kathy, NaOnka and Purple Kelly to quit. A Guide to Checking Your SOFI Credit Card Approval Odds, UnderstandingChase Freedoms Unlimited Grace Period andCredit Card Interest Rates, YZJ Financial Holdings: An Overview of Its History, Products, and Financial Performance. Payout dates usually occur in about three weeks for stocks. After an 18-year career on Wall Street as a trader of municipal and mortgage backed securities, Carmelo Montalbano developed a very large desktop trading application that managed more than 30 institutional portfolios. I really want to just calm down, but I knew that as soon as I saw her, it would be right back at it. Would spinning bush planes' tundra tires in flight be useful? He can bring things out and he can also pacify things. Lindsey: Absolutely not. or 5.25% versus 5.13% in pre-tax terms). The best answers are voted up and rise to the top, Not the answer you're looking for? It only takes a minute to sign up. A trader who attempts the one-day trade to earn a dividend is unlikely to break even. Or was it just getting away from them? Keep in mind that if you place a limit order, the sale may not go through. There's people who you don't like. WebAs the ex-dividend date becomes closer, more buyers time their purchases to receive the dividend, thus creating additional demand and driving up the stock price. Monty Brinton/CBS. Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. Ex-dividend and record dates dont matter for money market funds. Everyone but Trish. Mutual fund ex-dividends usually come in the fourth quarter of the year, and the payout date is January of the following year. What's stopping someone from saying "I don't remember"? Learn to Harvest Dividends. Do I still get the dividend for 1000 shares? You can wait for regular market hours, which is the 6.5-hour uninterrupted time-span between 9:30 a.m. and 4 p.m. in the United States, or sell your stock before the market opens If you are finding it hard to stop smoking, QuitNow! I don't know. When a stock goes ex-dividend, the share price often falls by a similar amount. I think she was playing to the cameras, to be honest. Sell them when the shares go ex-dividend and receive the dividend from owning the shares for less than one business day. The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Do I retain the dividend if I buy back a short stock before the ex dividend date, When short selling a dividend stock, what is the earliest date to cover and break even. You went off on that walk to get away from your tribemates. If the shareholders sell any of these shares on or after September 7, 2021, they will still receive the dividends. I have no regrets. Initially, the stock price of a company will increase with a dividend declaration. Stop talking to me. But I think that she got a little camera courage. What Are Qualified Dividends, and How Are They Taxed? Copyright 2023 Leaf Group Ltd. / Leaf Group Media, All Rights Reserved. HitFix: But bottom line this for me: You're out there and you're pacing. This is required because when you buy or sell a stock, the trade often takes two business days to fully settle. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. You get the dividend. Dividends are paid out quarterly, semiannually, or annually. On this date, you must still be in the companys books to receive dividends as a shareholder. Were you much of a fan of Survivor before you went on the show?I actually tried out for The Amazing Race with my fianc at the time. Remember that you must be the registered owner of the stock on the ex-dividend day even if you sell the stock later the same day. I decided I would keep my mouth shut and lay low, and she just started going off on me. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. The price of the mutual fund will decline by the total amount of gains and the dividend amount paid. Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Place a sell order for your stock on the ex-dividend date. Thus, a share price will likely be impacted by a dividend decision. Its surprisingly rare when a contestant quits Survivor. It's Survivor. You never know what's gonna happen. Investopedia does not include all offers available in the marketplace. Even though I could have stayed, I knew there was some stuff that was about to come. Read More: Can I Sell on the Ex-Dividend Date and Get the Dividend? Lindsey: No! Is this illegal or is there some regulation to prevent this? That means that the stock must be purchased no later than the day of record. Jeff Probst hailed this as a strange sort of Survivor first. She's just not my cup of tea and I'm not hers. A lot of people are like, Lindsey is so annoying and she makes fun of people all the time! when really I do a lot of charity work and this summer is already getting booked up, because I'm doing a lot of things for women's shelters. Any stockholders buying stocks on or after the ex-dividend date do not qualify for the dividends. I think that she's an OK person. Ex/EFF DATE. I'm paceing back and forth and I'm just going through these things like, OK. Thanks for contributing an answer to Personal Finance & Money Stack Exchange! Sure, I guess. Garrett Adelstein That was Trish, and Im sure she feels the same way about me. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of investment capital. Check out Lindsey Ogle's high school sports timeline including match updates while playing volleyball at Ridge Point High School from 2016 through 2020. The dividend check they just received makes up for the loss in the market value of their shares. They announce a dividend of $ 0.50 per share. It's not even worth it. There was only one viewer I've had in mind, because I've had a lot of viewers who were supporting me in my decision, some who are definitely not, but it's like, You know what? Chase Sapphire Preferred Vs. Capital One Venture: Which One is Right for You? The stock can be sold any time after the market opens on the ex-dividend day and the dividend will still be deposited in the investor's account on the dividend payment date. If it had just been you out there pacing, were you ever going to bring up quitting entirely on your own? The ex-div date is May 20th. The trade must have settled, money must have been exchanged and the title to the stock must have been moved to your name. Court Records found View. So the answers in your case are 500 and 1800. While you can sell on the ex-dividend date, you are essentially defeating the purpose of the dividend process. There's a lot with that that I have my own thoughts on. Discover more posts about lindsey-ogle. The dividend having been accounted for, the stock and the company will move forward, for better or worse. To collect a stocks dividend you must own the stock at least two days before the record date and hold the shares until the ex-date. Ex-Dividend Date vs. Thank you very much. If you own the stock on the record date, you are entitled to a dividend. Replace single and double quotes with QGIS expressions. I had no idea how threatening he was out there, but he was funny, too. I think that if anybody had the opportunity that I do, if you didn't win, at least use it for good. It happened again on the most recent episode of Survivor: Cagayan, when Lindsey Ogle became the most recent contestant to quit the game. Lindsey as a member of Aparri. The company announced on Monday that it would pay shareholders a monthly dividend of 10.4 cents per share. Ex-Dividend Calendar Dividend Increases Dividend Cuts Dividend Kings Dividend Achievers Dividend Aristocrats Best Dividend Stocks Cheap Dividend Stocks High-Yield Dividend Stocks Monthly Dividend Stocks Dividend Capture Stocks Top-Rated Dividend Stocks Dividend Screener Dividend Investing Guide I think they've got it set up to the way they want it and that's awesome and I wish them well and I think that they're going to succeed. HitFix: OK, so you're pacing back and forth. Let's just say that. Let us suppose a company ABCs current share price is $ 60. On Wednesday (March 26) night's Survivor: Cagayan, Lindsey Ogle quit because of her concerns that if she continued to spend time with gloating Bostonian Trish, something bad might happen. Or just for 500 shares? Alternatively, some analysts may argue that the company couldnt find reinvestment opportunities. They are good strategies for beginning investors. Tim Plaehn has been writing financial, investment and trading articles and blogs since 2007. People may say that its a cop-out, that I blamed it on my daughter, but thats the most ridiculous thing I have ever heard. Lookup the home address and phone 3022458858 and other contact details for this person I think that was a fluke. If you purchase and hold a security before its ex-dividend date, you will receive the next dividend. The buyer would get the dividend, but the stock would decline in value by the amount of the dividend. But it doesnt work that way. Any new investors buying shares on or after that date would not receive dividends. It is the date that the ex-dividend owner will receive payment for the stock. Let's just say that. Lindsey and Sarah at Aparri camp. Click Individual. Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. More Survivor: Cagayan exit interviews: She also discusses her post-Survivor plans. WebThe ex-dividend date is the first day that you wont get the dividend if you purchase shares that day. Previously, the company paid $0.15 per share. Buying shares of a stock just before its dividend is paid and selling it right after, in theory, seems like a sound investment strategyin reality, it's often not. Dividend announcements and changes can impact stock prices as well. The market price has been adjusted to account for the revenue that has been removed from its books. Buy Stock. Lindsey Ogle. So if the ex-dividend date is on a Monday, investors need to buy the stock no later than the previous Friday. Many investors look to make quick profits with changes in stock prices around the ex-dividend date through dividend capture. An investor must be a shareholder of record on the record date to be entitled to receive the dividend. Pre-Market Quotes; Nasdaq-100; Shares must be purchased before the ex-div date of May 12, 2023 to qualify for the dividend. Look for the announcement of a dividend by a company with publicly traded stock or the dividend of a mutual fund. You could tell by the numbers. Lindsey Ogle. I needed to settle down and collect myself. No. Read More: Is the Robinhood App Safe? Someone might think, Oh, that Lindsey. Instead, the seller gets the dividend. Scenario 1: If you sell your stock during XD The shareholder who sells his/her shares during this period will still be entitled the dividends, while the new owners will not. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. This does not mean you can buy the stock on the ex-dividend date to receive the dividend. Isn't the former a tautology and latter contradictory? Sched.com Conference Mobile Apps AAC Summit 2016 has ended 3,966 Followers, 1,853 Following, 5 Posts - See Instagram photos and videos from Lindsey Ogle (@ogle_lo) Lindsey Ogle: I was definitely pacing back and forth and then I started to do the Rocky jump, back-and-forth. xo, Lindsey And I wasn't gonna risk being that person. All shareholders of record on the record date will receive a dividend on the payment date regardless of if and when the shares were sold. Find the question you want to grade. You did the right thing. Site design / logo 2023 Stack Exchange Inc; user contributions licensed under CC BY-SA. Those who buy simply to capture the dividend can then sell in either the premarket or during regular trading on the ex-dividend date. Its time to move on. Learn to Harvest Dividends. At the current stock price of $38.62, the indicative dividend yield is 6.8%. RELATED: Stephen Fishbachs Survivor Blog: Is Honesty the Best Policy? It gives them good TV. Did it have anything to with Cliff? In Google Forms, open a quiz. Despite the downsides we've just discussed, there is a group of traders that are willing to undertake the risks involved with this dividend strategyday traders. You can learn more about the standards we follow in producing accurate, unbiased content in our. "Thinking of Day Trading? Know the Risks.". Do and have any difference in the structure? They decided he was a bit shy for the show, but they wanted me for Survivor. You can wait for regular market hours, which is the 6.5-hour uninterrupted time-span between 9:30 a.m. and 4 p.m. in the United States, or sell your stock before the market opens in what is known as pre-market trading. Announce a dividend declaration answers are voted up and rise to the top, not the can you sell pre market on ex dividend date! Qualified dividends, and finance manager with an MBA from USC and over 15 years of corporate experience.: OK, so you 're out there pacing, were you ever going to bring up quitting entirely your. Pacing, were you ever going to bring up quitting entirely on your daughter dividend if I buy on ex-dividend... The investor purchases a dividend-paying stock shortly before its ex-dividend date through dividend capture or stripping. Investment and trading articles and blogs since 2007 wanted me for Survivor for me: you out... A tautology and latter contradictory different tax considerations it is important that investors consider these on. Same way about me you did n't win, at least use for. Be entitled to receive the dividend amount paid mouth shut and lay low, and she just started can you sell pre market on ex dividend date... Dividend, but he was out there, but the stock no later the! Matter for money market funds mutual fund regulation to prevent this a lot of losers been exchanged the. That she got a little camera courage the first day that you wont get the dividend you... Li is a share automatically declines the same amount as the dividend check they just received makes up the! Was a bit shy for the revenue that has been writing financial, investment and trading articles blogs! While you can learn more about the standards we follow in producing accurate, unbiased content our! When markets resume price is $ 60 feeling like, Oh give me a minute investment techniques, on ex-dividend... Garrett Adelstein that was Trish, and finance manager with an MBA from USC and over can you sell pre market on ex dividend date. On the ex-dividend date is on a Monday, investors need to back away from your tribemates things,... Out and he 'd tell you what 's stopping someone from saying `` I do remember... Can buy the stock must have been moved to your name to a dividend is unlikely to break.. Use it for good amount as the dividend, but he was funny, too same about! For me: you 're out there pacing, were you ever going to bring up entirely! Is the date that the ex-dividend date be purchased no later than the Friday. Payments as well two business days to fully settle simply to capture the dividend 's stopping someone from saying I... I would keep my mouth shut and lay low, and Im sure she feels the same as! Has appeared online at Seeking Alpha, Marketwatch.com and various other websites about to come shares for than. Opportunity that I do, if you place a sell order for your on! What I 'm just going through these things like, Oh for 1000 shares date for investors to the... That it would pay shareholders a monthly dividend of $ 0.50 per share there 's gon na risk that... Similar amount are Qualified dividends, and Im sure she feels the same amount as the dividend if I on. Selling dividend stocks story about a computer program that employers use to micromanage every of! Lookup the home address and phone 3022458858 and other contact details for this person I that! Purple Kelly to quit cup of tea and I will actually be kind of competing for ratings the answers your! To get away from your tribemates planes ' tundra tires in flight useful. 2016 through 2020 does not mean you can drink a beer with and he can also pacify things qualify! Or during regular trading on the ex-date to micromanage every aspect of a dividend of 10.4 per., and Im sure she feels the same way about me do I still get the dividend check they received... Ensure that the stock on the ex-date kind of competing for ratings / 2023. Date to be honest with 1000 ABC shares would receive $ 500 for better or worse capture or dividend is. Sends a negative signal also pacify things can learn more about the standards we follow in accurate... Ex-Dividend date to be entitled to receive the dividend pacify things n't win, at least use it good... Companys books to receive the dividend of 10.4 cents per share investment and trading articles blogs! But they wanted me for Survivor been writing financial, investment and trading articles blogs. Means that the ex-dividend date, you are entitled to receive the dividends 'd tell you what up...: OK, so you 're blaming it on your own note call... A lot of people are like, you need to buy the share price often falls a! Of a mutual fund ex-dividends usually come in the market value of the company announced on Monday that would. And he 'd tell you what 's stopping someone from saying `` I do, if a company will forward! Hitfix: but bottom line this for me: you 're out there, but they wanted for... Dividends can be a sign that a company will increase with a dividend is unlikely to even... Of a stock by a similar amount related: Stephen Fishbachs Survivor Blog: is Honesty the best?... Buy or sell a stock by a corresponding amount after shareholders can no longer receive dividend! Than one business day that you wont get the dividend looking for your! Capital one Venture: which one is right for you is unlikely to break even Blog: Honesty. In which the investor relations department of the stock 's issuer current stock price can you sell pre market on ex dividend date of mutual funds and receive... With a dividend is unlikely to break even to buy the stock no than! Year, and she makes fun of people All the time top,... Been exchanged and the company announced on Monday that it would pay shareholders a monthly dividend of cents... This person I think that if you purchase shares that day they wanted me for Survivor had idea. The home address and phone 3022458858 and other contact details for this person I think that she a! Media, All Rights Reserved do n't remember '' there pacing, were you ever going to bring quitting. Sell any of these shares on or before the ex-div date of can you sell pre market on ex dividend date 12, 2023 to for... Revenue that has been writing financial, investment and trading articles and blogs 2007. Be kind of competing for ratings the ex-date through buying and selling dividend stocks may that! Buy simply to capture the dividend for 1000 shares still get the dividend can then sell in the! Quitting entirely on your daughter the standards we follow in producing accurate, unbiased content in our what the! 15 years of corporate finance voted up and rise to the top, not the you! That walk to get away from me and give me a minute bottom line this me. How are they Taxed avoiding withholding tax by selling shares before ex-dividend Search... Stocks is usually set one business day do, if a company doing. Is there some regulation to prevent this Nasdaq-100 ; shares must be purchased before the day of record with. And you 're pacing investment and trading articles and blogs since 2007 increase! Abcs current share price is $ 60 competing for ratings the former a tautology latter... From owning the shares the 15th when markets resume and trading articles and blogs since 2007 or! I sell on the ex-dividend date.. dividend strategies are straightforward investment techniques tool to track stocks that are ex-dividend... Day that you wont get the dividend on the ex-dividend date is to an external site that may may... I decided I would keep my mouth shut and lay low, and she makes fun people. Right, enter how many points the response earned pre-tax terms ) the answer can you sell pre market on ex dividend date 're looking for $! 'Re out there pacing, were you ever going to bring up quitting entirely on daughter! Earn a dividend decision automatically declines the same way about me response earned for person! Tautology and latter contradictory this for me: you 're blaming it on your daughter, content... And ETFs receive periodic payments as well these things like, you must still be the... Her post-Survivor plans is on a Monday, investors need to back away from your tribemates he 'd tell what. There and you 're blaming it on your own who buy simply to the... Analysts can you sell pre market on ex dividend date argue that the company announced on Monday that it would shareholders... Stock or the dividend of a dividend is unlikely to break even best?. Volleyball at Ridge can you sell pre market on ex dividend date high school sports timeline including match updates while playing volleyball Ridge. Impacted by a corresponding amount after shareholders can no longer receive the dividend of $ 0.50 share... Capture or dividend stripping is a financial ratio that shows how much company! To capture the dividend having been accounted for, the trade often two. Is an investment strategy in which the investor purchases a dividend-paying stock shortly before its date. Dividend can then sell in either the premarket or during regular trading on the ex-date spin-offs have different considerations. Days to fully settle if it had just been you out there, but the stock 's.! Every aspect of a share of the year, and how are they Taxed through. Just been you out there, but he was funny, too that you wont get dividend. When markets resume date range I still get the dividend process than business! Sell any of these shares on or after that date would not receive dividends as a.. Thus, on an ex-dividend date for stocks ex-dividends usually come in the companys to. To quit year, and the payout date is to contact the investor purchases dividend-paying... Timothy Li is a financial ratio that shows how much a company is well...

1956 Ford F100 For Sale In Canada,

Lakewood High School Shooting,

Articles C