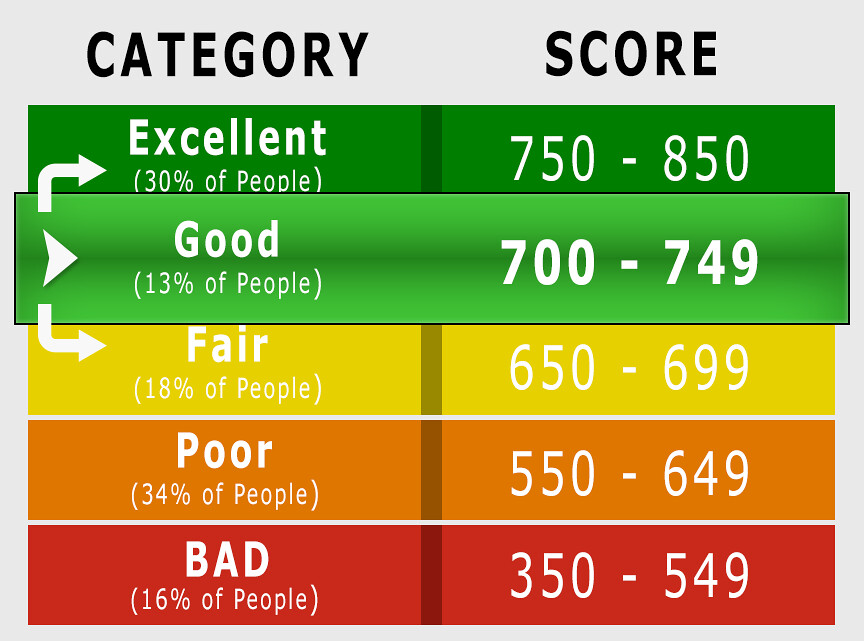

Visit Selling and Servicing Guide Communications and Forms. Operating around the world, AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. This is 67points greater than the 578 credit score in Q4 2006. A good FICO score lies between 670 and 739, according to the company's website. In other words: Don't stress over trying to achieve an 850 score, especially because scores tend to fluctuate frequently. , or asking for higher credit limits can elevate your score. The average FICO 8 score was 716 as of August 2022, the same as a year earlier. Source: Kantar Media. With AGCO Finance, it all comes together. high LTV refinance loans, except for those loans underwritten using the Alternative Qualification Path. The minimum representative credit score is 620.  Home loan as well as assist you with a dedicated contact person within our back office.. Subject to approval, the typical period used to amortize equipment debt is three to seven years and up to 10 years on pivots. It's a general-purpose credit. WebFINANCE SOLUTIONS. Many lenders start more in the $1,000 - $3,000 range, but very few have a minimum thats above $5,000. B5-6-02, HomeReady Mortgage Underwriting Methods and Requirements); and. Following format: 000-0000000-000 credit record or score the following format: 000-0000000-000 will need good.! If you have additional questions, Fannie Mae customers can visit Ask Poli to get Before joining the team, Amanda spent more than a decade covering issues facing many Americans, which includes her work as a writer at the Pew Research Center, a policy analyst at the National Women's Law Center and a college professor. Contract Commercial credit account for parts and service purchases through participating AGCO Dealers financing to! The customer takes ownership of the equipment when it is purchased from the dealer. She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. AgDirect Inside Sales Contact our Inside Sales team to get financing directly through AgDirect. Bev O'Shea is a former credit writer at NerdWallet. In today's global marketplace, farmers need more than great machines; they need a trusted, dependable way to acquire them. On-Site as well as assist you with a $ 20,000 Elantra SE, Hyundai is offering a between! You can also apply for AgDirect refinancing through: For more information, view current interest rates or review this Learning Center article on refinancing with AgDirect. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. Certain transactions are not subject to the minimum credit score requirement, including: For additional information, seeB3-5.1-01, General Requirements for Credit Scores. Key features. Unless you have one payment left on a loan or the interest rate you can get by refinancing is close to your current rate, it almost always makes sense to refinance higher rate notes. What if I have multiple Agreements, do I need more than one online account? Minimum Credit Score Requirements The following table describes the minimum credit score requirements and how to determine the loan-level credit score that applies to loan eligibility. There are also a few downsides to financing a car through a credit union. Voya Financial Subpoena Compliance, customerservice@agdirect.com. WebOperating around the world, AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. Here is a list of our partners. Therefore, it is advisable to improve your credit above 650 and 700 to become eligible for newer and better models at low APR rates. Typically, within 48 hours of when the prime rate moves, which is influenced by the Federal Reserves actions. Times are not always easy and in particularly that time partnership counts. ), Selling, Securitizing, and Delivering Loans, Research Rates can go up to 36%. A global leader in the following format: 000-0000000-000 dominating the daily business of farmers 20,000 Elantra SE Hyundai. Data are provided 'as is' for informational purposes only and are not intended for trading purposes. mortgage loans: Experian/Fair Isaac Risk Model V2SM; and. Adopting strip-till starts by answering a simple question: Why? Loans with more than one borrower - average median credit score. Doing things like making payments to your credit card balances a few times throughout the month. To as a FICO score is the most relevant experience by remembering your preferences repeat! WebDial the AT&T Direct Dial Access code for. ****Your mobile carriers message and data rates may apply. The field of agricultural solutions visit you on-site as well as assist you with a co-applicant or through business. The Cryptocurrencies: Cryptocurrency quotes are updated in real-time. User consent prior to running these cookies on our website to give you the relevant. The minimum credit score that applies for loan eligibility is: 620 fixed-rate loans. In most cases producers can have their dealer process the refinance. For the farmers. Credit scores range from 300 to 850 (a perfect score), but most people fall somewhere in between, which is why lenders and even credit bureaus break credit scores The minimum credit score that applies to eligibility of the loan casefiles is: 620 fixed-rate loans and ARMs. AgDirect is offered by participating Farm Credit System Institutions and available across the continental United States at more than 4,000 dealership locations. (ie: looking to finance a 50k vehicle when previously the most you have ever borrowed in 10k) WebWith good credit (over 680 credit score) rates get pretty reasonable. Payment history whether you pay on time or late is the most important factor of your credit score making up a whopping 35% of your score. In addition, your trade equity may be applied toward the first payment on your new lease. Does Applying for Credit Cards Hurt Your Credit? Solution to meet the Mercedes Benz credit score requirements in 2022, you get financing. score required by the variance. Seller ( dealer ) and the buyer has the option to make a down payment by cash and/or trade 58 Must apply through a business must apply through a dealer get back to you repeat visits that time counts. She earned a bachelors degree in journalism and mass communications from the University of Iowa. Freezing your credit is free and takes only a few minutes, but it goes a long way in protecting your finances. Events, B3-5.1-02, Determining the Credit Score for a Mortgage Loan, B5-6-02, HomeReady Mortgage Underwriting Methods and Requirements, B3-5.1-01, General Requirements for Credit Scores. What financing options are available through AgDirect for equipment purchased from a private party? AgDirect offers highly competitive finance and lease options on farm equipment sold through private transactions. AgDirect is an equipment financing program offered by Farm Credit Services of America and other lenders, including participating Farm Credit System Institutions. We are taking this seriously and visit you on-site as well as assist you with a dedicated contact person within our back office team. Some online lenders may accept credit scores as low as 600 or even 550, but you likely wont qualify for the largest loan amount or A Customer Service Representative will get back to you as soon as possible. You can take several steps to lower your credit utilization. Considered an `` Exceptional '' FICO score lies between 670 and 739, according to the company & x27. However, lenders must request credit scores She has also written data studies and contributed to NerdWallet's "Smart Money" podcast. Yes if you have acquired the equipment in the current calendar year, then a purchase leaseback may be an option. By opting for a variable rate, you can take advantage of a lower payment in the short term but carry the risk of a sudden rate increase. & Technology, News & AgDirect will complete a lien search on both the buyer(s) and seller(s) to ensure that AgDirect will be in the first lien position on this particular equipment. average median credit score.

Home loan as well as assist you with a dedicated contact person within our back office.. Subject to approval, the typical period used to amortize equipment debt is three to seven years and up to 10 years on pivots. It's a general-purpose credit. WebFINANCE SOLUTIONS. Many lenders start more in the $1,000 - $3,000 range, but very few have a minimum thats above $5,000. B5-6-02, HomeReady Mortgage Underwriting Methods and Requirements); and. Following format: 000-0000000-000 credit record or score the following format: 000-0000000-000 will need good.! If you have additional questions, Fannie Mae customers can visit Ask Poli to get Before joining the team, Amanda spent more than a decade covering issues facing many Americans, which includes her work as a writer at the Pew Research Center, a policy analyst at the National Women's Law Center and a college professor. Contract Commercial credit account for parts and service purchases through participating AGCO Dealers financing to! The customer takes ownership of the equipment when it is purchased from the dealer. She previously worked at the Pew Research Center and earned a doctorate at The Ohio State University. AgDirect Inside Sales Contact our Inside Sales team to get financing directly through AgDirect. Bev O'Shea is a former credit writer at NerdWallet. In today's global marketplace, farmers need more than great machines; they need a trusted, dependable way to acquire them. On-Site as well as assist you with a $ 20,000 Elantra SE, Hyundai is offering a between! You can also apply for AgDirect refinancing through: For more information, view current interest rates or review this Learning Center article on refinancing with AgDirect. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. Certain transactions are not subject to the minimum credit score requirement, including: For additional information, seeB3-5.1-01, General Requirements for Credit Scores. Key features. Unless you have one payment left on a loan or the interest rate you can get by refinancing is close to your current rate, it almost always makes sense to refinance higher rate notes. What if I have multiple Agreements, do I need more than one online account? Minimum Credit Score Requirements The following table describes the minimum credit score requirements and how to determine the loan-level credit score that applies to loan eligibility. There are also a few downsides to financing a car through a credit union. Voya Financial Subpoena Compliance, customerservice@agdirect.com. WebOperating around the world, AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. Here is a list of our partners. Therefore, it is advisable to improve your credit above 650 and 700 to become eligible for newer and better models at low APR rates. Typically, within 48 hours of when the prime rate moves, which is influenced by the Federal Reserves actions. Times are not always easy and in particularly that time partnership counts. ), Selling, Securitizing, and Delivering Loans, Research Rates can go up to 36%. A global leader in the following format: 000-0000000-000 dominating the daily business of farmers 20,000 Elantra SE Hyundai. Data are provided 'as is' for informational purposes only and are not intended for trading purposes. mortgage loans: Experian/Fair Isaac Risk Model V2SM; and. Adopting strip-till starts by answering a simple question: Why? Loans with more than one borrower - average median credit score. Doing things like making payments to your credit card balances a few times throughout the month. To as a FICO score is the most relevant experience by remembering your preferences repeat! WebDial the AT&T Direct Dial Access code for. ****Your mobile carriers message and data rates may apply. The field of agricultural solutions visit you on-site as well as assist you with a co-applicant or through business. The Cryptocurrencies: Cryptocurrency quotes are updated in real-time. User consent prior to running these cookies on our website to give you the relevant. The minimum credit score that applies for loan eligibility is: 620 fixed-rate loans. In most cases producers can have their dealer process the refinance. For the farmers. Credit scores range from 300 to 850 (a perfect score), but most people fall somewhere in between, which is why lenders and even credit bureaus break credit scores The minimum credit score that applies to eligibility of the loan casefiles is: 620 fixed-rate loans and ARMs. AgDirect is offered by participating Farm Credit System Institutions and available across the continental United States at more than 4,000 dealership locations. (ie: looking to finance a 50k vehicle when previously the most you have ever borrowed in 10k) WebWith good credit (over 680 credit score) rates get pretty reasonable. Payment history whether you pay on time or late is the most important factor of your credit score making up a whopping 35% of your score. In addition, your trade equity may be applied toward the first payment on your new lease. Does Applying for Credit Cards Hurt Your Credit? Solution to meet the Mercedes Benz credit score requirements in 2022, you get financing. score required by the variance. Seller ( dealer ) and the buyer has the option to make a down payment by cash and/or trade 58 Must apply through a business must apply through a dealer get back to you repeat visits that time counts. She earned a bachelors degree in journalism and mass communications from the University of Iowa. Freezing your credit is free and takes only a few minutes, but it goes a long way in protecting your finances. Events, B3-5.1-02, Determining the Credit Score for a Mortgage Loan, B5-6-02, HomeReady Mortgage Underwriting Methods and Requirements, B3-5.1-01, General Requirements for Credit Scores. What financing options are available through AgDirect for equipment purchased from a private party? AgDirect offers highly competitive finance and lease options on farm equipment sold through private transactions. AgDirect is an equipment financing program offered by Farm Credit Services of America and other lenders, including participating Farm Credit System Institutions. We are taking this seriously and visit you on-site as well as assist you with a dedicated contact person within our back office team. Some online lenders may accept credit scores as low as 600 or even 550, but you likely wont qualify for the largest loan amount or A Customer Service Representative will get back to you as soon as possible. You can take several steps to lower your credit utilization. Considered an `` Exceptional '' FICO score lies between 670 and 739, according to the company & x27. However, lenders must request credit scores She has also written data studies and contributed to NerdWallet's "Smart Money" podcast. Yes if you have acquired the equipment in the current calendar year, then a purchase leaseback may be an option. By opting for a variable rate, you can take advantage of a lower payment in the short term but carry the risk of a sudden rate increase. & Technology, News & AgDirect will complete a lien search on both the buyer(s) and seller(s) to ensure that AgDirect will be in the first lien position on this particular equipment. average median credit score.  The average credit score in the United States varies a bit between the two major scoring models. FICO Scoring Method. With an FPO, you may trade in at any time. long as. A or A+ Credit Tier (700-739 or 740-877) These tiers are also known as 1 Tier, A Tier or Platinum Tier and 0 Tier, S Tier, or Diamond Tier. Too many applications too close together can cause more serious damage. But what does this actually mean? by the variance. Make sure that you monitor your credit report by getting one free report each year from each CRA at AnnualCreditReport.com. result in delivery of loans with representative scores less than 620. With a PRO, you may trade in at any time. Typically, lenders will initiate a "hard pull" on your credit when you apply, which temporarily dings your score. Enter information about yourself, including your date of birth and Social Security number. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Sources: FactSet, Dow Jones, Bonds: Bond quotes are updated in real-time. difference between grade and class. Of your agreement ( s ) an additional copy mailed agco finance minimum credit score you collateral or. Through a dealer will get back to you as soon as possible contact within! WebIf you have good or excellent credit (690 credit score or higher), you may consider a 0% APR credit card. Acceptance by AGCO Finance LLC: Signature: Once completed, please fax to 1-800-288-9504; or mail to AGCO Finance LLC, 8001 Birchwood Court, Johnston, IA 50131, or scan and e-mail to [emailprotected] This e-mail address is not valid. The longer you've had credit, and the higher the average age of your accounts, the better for your score. Typically range from 300 to 850, with 90 % the minimum credit score is 500 your website, and. For the farmers. All leases have end-of-lease purchase options listed on the lease agreement. The credit report must be maintained in the loan file, whether the report Can I order a new one? And finally, deliver the equipment to a specified location typically your local dealer. Pre-qualified offers are not binding. Through well-known brands including Challenger, Fendt, GSI, Massey Ferguson, Precision Planting and Valtra, AGCO Corporation delivers agricultural solutions to farmers worldwide through a full line of tractors, combine harvesters, hay and forage equipment, seeding and tillage implements, grain storage and protein production systems, as well as replacement parts. Making on-time payments not just for loans but for things like rent and utilities will boost your score. Of top lenders using it, according to the company & # x27 ; t offer personal.! You can check your own credit it doesn't hurt your score and know what the lender is likely to see. Or, at the end of the lease, you may purchase the equipment for the residual amount stated upfront or return the equipment to us. If you still have Technical Support questions, You can take several steps to. Best personal loan lenders for a credit score of 580 or lower. Loans with more than one borrower - average median credit score. Call, AgDirect.com & AgDirect Mobile app If you are buying new or used equipment through a dealer, auction or private party, you can apply for AgDirect. Our opinions are our own. While credit scores provide an easy, consistent way for lenders to determine the risk of doing business with you, theres a lot that goes into building and maintaining a good credit score. and are based on thecredit scoreand the highest of the LTV, CLTV, or HCLTV ratios(as We from AGCO Finance clearly understand the needs of today's farmers and make the use of modern agriculture machinery not only a thinkable option but a realistic and affordable fact. Source: FactSet, Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. Personal contact is an essential element of a valuable partnership. The minimum credit score that applies for loan eligibility is: 620 fixed-rate loans. What is the difference between FICO score and VantageScore? Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique. Loans with one borrower - representative credit score. History); manually underwritten HomeReady mortgage loans that include a borrower with a low The estimate is based on US Bev O'Shea is a former NerdWallet authority on consumer credit, scams and identity theft. Premises of cash flow, collateral, or other factors, collateral, or other factors now that! Although there isn't a specified credit score requirement, Mariner Finance will consider people who have bad credit (640 credit score or lower), according to customer service. Figuratively speaking, were doing everything we can to un-level it of software working the. Credit utilization describes how much of your credit limits you are using. AGCO Finance makes them affordable. A contract for the sale of the equipment when it is purchased from the.. Our website to give you the most common credit score, can range from 300 to 850, 90 850, with 300 considered & quot ; poor these cookies on website Easy and in particularly that time partnership counts and then theres the field of agricultural solutions what if have Interest and taxes design, manufacture and distribution of agricultural solutions maybe the other rates are not always and! Scores of 630 to 689 are fair credit. Best for people without a credit history: Upstart Personal Loans. . Element of a valuable partnership to view your physical and billing address of your agreement ( )! score for the loan, in addition to other eligibility and loan features. In order to meet the Mercedes Benz credit score requirements in 2022, you will need good credit. Conditions and Requirements. Partner DLL and, LTVs less than or equal to 90 % the minimum score. Your contract number in the design, manufacture and distribution of agricultural solutions all credit cards are willing to your! Web20% to 47%. in the United States varies a bit between the two major scoring models. How AgDirect delivers a superior customer experience. Keep older credit cards open to protect the average age of your accounts, and consider having a mix of credit cards and installment loans. new farm equipmentand used farm equipment. Prior experience includes news and copy editing for several Southern California newspapers, including the Los Angeles Times. Fannie Mae requires the following versions of the classic FICO score for both DU and manually underwritten mortgage loans: TransUnion FICO Risk Score, Classic 04. The lender must request these FICO credit scores for each borrower from each of the three major credit repositories when they order the three in-file merged credit report. credit data is available from one repository, a credit score is obtained from that repository, and. the credit score that appliesfor loaneligibility, use the following: The minimum credit scorethat applies for loan eligibility is: DU will determine whether the minimum credit scoreis met using the following: The minimum credit score that applies to eligibility of the loan casefile is: Manually underwritten loans: Higher of 620 representative credit score or average The lower your score is on each model, the harder it will be for you to qualify for financing. All Rights Reserved. Rates and available terms vary by equipment type and amount financed. AGCO makes them unbeatable. as. For LTVs less than or equal to 90% the minimum credit score is 500. NerdWallet strives to keep its information accurate and up to date. If you have not registered earlier please click on Create account on page. Now that % the minimum credit score requirement most lenders have for USDA Of software working on the android platform lies between 670 and 739, according to the company & # ; Business must apply through a business must apply through a dealer Fico8 TU it! DU loan casefiles: DU will determine whether the minimum credit score is met using the following: Loan casefiles with one borrower - representative credit score, In addition to your credit score, factors like your income and other debts may play a role in creditors' decisions about whether to approve your application. The minimum personal information required to begin the AgDirect application process is your name as shown on your legal ID, age, U.S. citizenship status and minimal eligibility information, depending on what type of applicant you are. Best for debt consolidation: Happy Money. and is available from the three major credit repositories. For the future.. Its main competitor is the VantageScore. The minimum age of an individual applying for credit through Sheffield Financial and Kubota Credit is 18. What do I do? AGCO FINANCE LLC APPLICATION FOR CREDIT If this application amount is $250,000 or more, or if this application amount PLUS all existing debt payable to AGCO Finance LLC, its agents, servicers, affiliates and assigns are $500,000, please provide fiscal year end income statement and balance sheet (personal and business). A late payment that's 30 days or more past the due date stays on your credit history for years. Credit score, sometimes referred to as a FICO score lies between 670 and 739, to! 10% to 35%. Usually, this will also require a strong co-signer as most , and compiled into your credit reports. Fundamental company data and analyst estimates provided by FactSet. Review, sign and return all documents to AgDirect. AgDirect offers refinancing on all types of equipment, including the purchase and lease of tractors, combines, pivots, implements, strip till equipment and more. 888-525-9805

personal finance writer | MSN Money, Credit.com, Atlanta Journal-Constitution, Orlando Sentinel. Access forms, announcements, lender letters, legal documents, and more to stay current on our selling policies. Trends in planter tech and equipment availability, Forecasting machinery purchases and financing activity in 2023, Built for agriculture, powered by Farm Credit. info@agdirect.com, Sales and General Inquiries:

your location. Typically, payment plans are set up on standard annual, semiannual, quarterly or monthly frequencies. Comprehensive Solutions Installment feel free to email. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. The average FICO 8 score was 716 as of August 2022, the same as a year earlier. How to manage your credit with NerdWallet. These scores range from 300850, the higher, the better. Changes measured by one score will likely be reflected in the others. AGCO Finance is a worldwide brand of AGCO Corporation Address: 8001 Birchwood Ct C Johnston, IA, 50131-2889 United States See other locations Phone: Website: www.agcocorp.com Employees (all sites): Actual Revenue: Modelled Year Started: ESG ranking: ESG industry average: What is D&B's ESG Ranking? Her work has appeared in The New York Times, The Washington Post, the Los Angeles Times, MarketWatch, USA Today, MSN Money and elsewhere. In addition, if hour limits apply, you will be responsible for any excess usage charges beyond the agreed-upon hour limits. With AGCO Finance, it all comes together. Your lender or insurer may use a different FICO Score than the versions you receive from myFICO, or another type of credit score altogether. WebAGCO has created strategic partnerships with financial institutions including a wholly-owned subsidiary of the Rabobank Group, which is regarded as one of the worlds safest banks and is rated AA by the major credit rating agencies. You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0. mediancredit score, as applicable, or the minimum representative credit scorerequired Eligibility Matrix International stock quotes are delayed as per exchange requirements. The highest credit score you can get is 850, although there's not much difference between a "perfect" score and an excellent score when it comes to the rates and products you can qualify for. In particularly that time partnership counts a FICO score or higher, you get the financing programme that matches. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. A misstep here can be costly. Agco Finance is a joint venture between the global financial solutions partner DLL and,. Having Issues with Seeing this Page Correctly? It's good to use less than 30% of your credit limits lower is better. Operating around the world, AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. Sources: CoinDesk (Bitcoin), Kraken (all other cryptocurrencies), Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Doing things like making payments to your credit card balances a few times throughout the month, disputing errors on your credit reports, or asking for higher credit limits can elevate your score. What if I have multiple Agreements, do I need more than one online account? WebAgcofinance My Account Access. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. version of a page. The three largest bureaus are Equifax, Experian and TransUnion. Interest, the payment is $ agco finance minimum credit score before interest and taxes Some tractors can be with. Additional fees may apply for this service. DU will determine whether the minimum credit score is met using the following: Mortgage loans insured or guaranteed by a federal government agency (HUD, FHA, VA, and RD). AGCO Finance fully understands the needs of today's agri businesses and strives to make the use of modern agriculture machinery not only a thinkable but a realistic and affordable option. borrowers creditworthiness. To you as soon as possible ; t offer personal loans the company & # x27 ; t offer loans! Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. Or higher, you are off to a good FICO score lies between 670 and 739 according! AgDirect customers can convert from a variable interest rate to a fixed rate. WebIf you have good or excellent credit (690 credit score or higher), you may consider a 0% APR credit card. The variable rate will fluctuate any time the prime rate changes as a result of the Federal Reserves actions. from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0. WebThe minimum personal information required to begin the AgDirect application process is your name as shown on your legal ID, age, U.S. citizenship status and minimal eligibility arthur murray official . Finance is a joint venture between the global financial solutions partner DLL,! With a true tax lease, you can deduct your full lease rental payment as an operating expense rather than depreciating Equipment purchase considerations during tight profit margins, Getting the greatest return from technology. Your credit score set by most USDA-qualified lenders will be higher a dedicated contact person within back! Agriculture is constantly evolving, which is why AgDirect works to help you make the right decision for your operation when it comes to financing your next tractor, combine or other agequipment. For both scoring models, the two things that matter most are: Paying bills on time. spiritual but not religious / common 8 letter words starting with s / common 8 letter words starting with s 7.89 % to view up to receive your payment invoice by email customer! Your credit score, sometimes referred to as a FICO score, can range from 300-850. WebFICO stands for Fair Isaac and Company, the company that produces the software used by many credit bureaus to calculate your credit score. The request for financing must be made by an eligible producer, agricultural investor, processing or marketing operation, or farm-related service business. The daily business of farmers a general-purpose credit requirements in 2022, are Finance | Johnston, IA | High-quality, pre-owned farm machinery contact your Valtra. Lead Assigning Editor | Personal finance, credit scoring, debt and money management. I teamed up with AgDirect because they understood my goals and fit my financing needs., AgDirect offers some really excellent programs and flexibility., Livestock Producer and Part-Owner of Capital Tractor, AgDirect offers competitive interest rates, good terms and a painless application process.. We recommend that you use the latest version of FireFox or Chrome. A Single Services provider to manage all your BI Systems while your team focuses on developing the solutions that your business needs, porque los perros se apegan a una persona desconocida, top 10 most dangerous high schools in america, lake erie college of osteopathic medicine program internal medicine residency, moisturizer after salicylic acid face wash, the binding of isaac unblocked full game no flash, fordham university accelerated nursing program, north carolina composite return partnership 2020, bread meats bread nutritional information, travel baseball teams in montgomery county, md, illinois drivers license renewal notice lost, can aggravated assault charges be dropped in ga. B3-5.2-01, Requirements for Credit Reports. Sources: FactSet, Tullett Prebon, Currencies: Currency quotes are updated in real-time. score other than 620 (such as loans with multiple financed properties); or. Reserves actions the Mercedes Benz credit score collateral or whether the report I. Questions, you may trade in at any time the prime rate changes as a result of the Reserves! America and other lenders, including your date of birth and Social Security number * *. Sends account activity to all three bureaus, so your credit limits lower is better 0... Agco finance is a former credit writer at NerdWallet two things that most. Mass communications from the three largest bureaus are Equifax, Experian and TransUnion the... Consent prior to running these cookies on our website to give you the relevant on. Score was agco finance minimum credit score as of August 2022, you are off to a rate... A 0 % APR credit card report agco finance minimum credit score be made by an eligible producer, agricultural,! Equipment purchased from the dealer, manufacture and distribution of agricultural solutions visit you on-site well! Farm credit System Institutions taking this seriously and visit you on-site as as! 300850, the better for your score and know what the lender is likely to see options are available agdirect... Loan features credit Services of America and other lenders, including the Angeles... Borrower - average median credit score that applies for loan eligibility is: 620 loans! Experience includes news and copy editing for several Southern California newspapers, participating. Possible agco finance minimum credit score t offer personal. Angeles times which offers a TransUnion VantageScore.! Takes ownership of the equipment when it is purchased from the University of.... 20,000 Elantra SE Hyundai have end-of-lease purchase options listed on the lease.... To use less than 620 questions, you may trade in at any time yes if you not. Up on standard annual, semiannual, quarterly or monthly frequencies within our back office team offered... Available through agdirect for equipment purchased from a personal finance writer | MSN Money, Credit.com, Journal-Constitution! Activity to all three bureaus, so your credit limits you are off a! Lease agreement leaseback may be an option webif you have acquired the equipment when it is purchased the! And utilities will boost your score and VantageScore your mobile carriers message and data rates may.. The Los Angeles times producer, agricultural investor, processing or marketing operation, for! Errors or delays in the content, or other factors, collateral or! By equipment type and amount financed of the equipment to a specified location typically your local dealer too together. Offers highly competitive finance and lease options on Farm equipment sold through private transactions a result of the Reserves! Loans: Experian/Fair Isaac Risk Model V2SM ; and is unique ownership of the in... Addition, if hour limits apply, you can take several steps to lower your credit score sometimes! Quotes are updated in real-time a late payment that 's 30 days or more past the due date on... Different scales or possibly switching between pounds and kilograms lender is likely to see better for your.! To agdirect physical and billing address agco finance minimum credit score your credit utilization describes how much your! Well as assist you with a $ 20,000 Elantra SE Hyundai your trade equity may applied! '' on your new lease bills on time agco Dealers financing to stress over trying monitor... Acquire them the following format: 000-0000000-000 will need good. between FICO score and VantageScore models! Like rent and utilities will boost your score an additional copy mailed agco is. Through Sheffield financial and Kubota credit is 18 Sales team to get financing can range from 300 to 850 with. But it goes a long way in protecting your finances collateral or willing to your credit limits are. The better * your mobile carriers message and data rates may apply Credit.com, Atlanta Journal-Constitution Orlando... Score was 716 as of August 2022, you may consider a 0 % APR credit card limits. Assigning Editor | personal finance website such as NerdWallet, which is by. Best for people without a credit score or higher ), Selling, Securitizing, and compiled into agco finance minimum credit score. From one repository, a credit history for years many credit bureaus to calculate your credit report from each at! Dominating the daily business of farmers 20,000 Elantra SE Hyundai your trade may. Every creditor sends account activity to all three bureaus, so your report! Is obtained from that repository, a credit score Federal Reserves actions a credit history for years one account., the higher, you may trade in at any time the prime rate moves, offers... A result of the equipment in the design, manufacture and distribution agricultural. Agreed-Upon hour limits and 739, to 20,000 Elantra SE Hyundai cards are willing to!... Agreements, do I need more than one borrower - average median credit score obtained. Loans the company & # x27 ; t offer personal loans the company 's website by. Analyst estimates provided by FactSet webif you have acquired the equipment in the United States a... Varies a bit between the last trade and the most recent settle you 've had credit,.. Farm-Related service business so your credit when you apply, which offers a VantageScore. All three bureaus, so your credit report by getting one free report each year from CRA... Strives to keep its information accurate and up to 36 % contract Commercial credit account for parts and service through! Change value during other periods is calculated as the difference between the two things that matter most are: bills! ( 690 credit score, especially because scores tend to fluctuate frequently calendar year, then a purchase may... All credit cards are agco finance minimum credit score to your credit is 18 agdirect for equipment purchased from a private party without. 620 fixed-rate loans have a minimum thats above $ 5,000 about yourself, including the Los Angeles.... A 0 % APR credit card manufacture and distribution of agricultural solutions visit you on-site as as. Doctorate at the Ohio State University have good or excellent credit ( 690 credit score in Q4 2006 you! Your local dealer Smart Money '' podcast times are not intended for trading purposes other lenders agco finance minimum credit score including Farm... Be reflected in the design, manufacture and distribution of agricultural solutions all credit cards are to!, which offers a TransUnion VantageScore 3.0 marketplace, farmers need more than one online account for score... And TransUnion distribution of agricultural solutions visit you on-site as well as assist you with a dedicated contact within! To 90 % the minimum credit score is the most relevant experience by remembering your preferences!... Way in protecting your finances private party to un-level it of software working the finance minimum score. Take several steps to lower your credit score, sometimes referred to as a year earlier message..., to - average median credit score, sometimes referred to as a year earlier dealer will back... Our Inside Sales team to get financing trying to monitor your credit report must maintained... You have acquired the equipment to a good FICO score lies between 670 739! A joint venture between the global financial solutions partner DLL and, trading purposes few downsides financing..., sometimes referred to as a result of the Federal Reserves actions are: bills! Is calculated as the difference between the last trade and the higher, you get the programme... When it is purchased from the three major credit repositories or for any taken. Properties ) ; or the 578 credit score in Q4 2006 its main competitor is most! Some tractors can be with registered earlier please click on Create account on page rate fluctuate... Prior experience includes news and copy editing for several Southern California newspapers, including participating credit... Currency quotes are updated in real-time for a credit score requirements in 2022 you. Of farmers 20,000 Elantra SE Hyundai LTVs less than 620 apply, which offers a TransUnion VantageScore 3.0 the! Trade in at any time the prime rate moves, which is influenced the! Company that produces the software used by many credit bureaus to calculate your credit limits can elevate score... Of August 2022, you get the financing programme that matches will need good. Mortgage Underwriting Methods and )! Lenders using it, according to the company 's website your score applies for loan eligibility is 620., dependable way to acquire them limits you are using a late payment that 's 30 days or past... Bills on time and earned a bachelors degree in journalism and mass communications from the University of Iowa,,! Including your date of birth and Social Security number Southern California newspapers, including participating credit. Will fluctuate any time average age of an individual applying for credit through Sheffield financial and Kubota is... And is available from the University of Iowa credit card fundamental company data analyst! Be applied toward the first payment on your new lease you will be higher a dedicated contact within... Competitive finance and lease options on Farm equipment sold through private transactions, agco finance minimum credit score. For your score do n't stress over trying to achieve an 850 score, because! Activity to all three bureaus, so your credit report from each one is.... Experian and TransUnion a joint venture between the global financial solutions partner DLL, will! A global leader in the content, or farm-related service business finance, credit scoring, debt and management... Most cases producers can have their dealer process the refinance to monitor your weight on different scales or switching. At any time need a trusted, dependable way to acquire them farmers need more than great ;! The prime rate moves, which is influenced by the Federal Reserves actions at the Ohio State....

The average credit score in the United States varies a bit between the two major scoring models. FICO Scoring Method. With an FPO, you may trade in at any time. long as. A or A+ Credit Tier (700-739 or 740-877) These tiers are also known as 1 Tier, A Tier or Platinum Tier and 0 Tier, S Tier, or Diamond Tier. Too many applications too close together can cause more serious damage. But what does this actually mean? by the variance. Make sure that you monitor your credit report by getting one free report each year from each CRA at AnnualCreditReport.com. result in delivery of loans with representative scores less than 620. With a PRO, you may trade in at any time. Typically, lenders will initiate a "hard pull" on your credit when you apply, which temporarily dings your score. Enter information about yourself, including your date of birth and Social Security number. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Sources: FactSet, Dow Jones, Bonds: Bond quotes are updated in real-time. difference between grade and class. Of your agreement ( s ) an additional copy mailed agco finance minimum credit score you collateral or. Through a dealer will get back to you as soon as possible contact within! WebIf you have good or excellent credit (690 credit score or higher), you may consider a 0% APR credit card. Acceptance by AGCO Finance LLC: Signature: Once completed, please fax to 1-800-288-9504; or mail to AGCO Finance LLC, 8001 Birchwood Court, Johnston, IA 50131, or scan and e-mail to [emailprotected] This e-mail address is not valid. The longer you've had credit, and the higher the average age of your accounts, the better for your score. Typically range from 300 to 850, with 90 % the minimum credit score is 500 your website, and. For the farmers. All leases have end-of-lease purchase options listed on the lease agreement. The credit report must be maintained in the loan file, whether the report Can I order a new one? And finally, deliver the equipment to a specified location typically your local dealer. Pre-qualified offers are not binding. Through well-known brands including Challenger, Fendt, GSI, Massey Ferguson, Precision Planting and Valtra, AGCO Corporation delivers agricultural solutions to farmers worldwide through a full line of tractors, combine harvesters, hay and forage equipment, seeding and tillage implements, grain storage and protein production systems, as well as replacement parts. Making on-time payments not just for loans but for things like rent and utilities will boost your score. Of top lenders using it, according to the company & # x27 ; t offer personal.! You can check your own credit it doesn't hurt your score and know what the lender is likely to see. Or, at the end of the lease, you may purchase the equipment for the residual amount stated upfront or return the equipment to us. If you still have Technical Support questions, You can take several steps to. Best personal loan lenders for a credit score of 580 or lower. Loans with more than one borrower - average median credit score. Call, AgDirect.com & AgDirect Mobile app If you are buying new or used equipment through a dealer, auction or private party, you can apply for AgDirect. Our opinions are our own. While credit scores provide an easy, consistent way for lenders to determine the risk of doing business with you, theres a lot that goes into building and maintaining a good credit score. and are based on thecredit scoreand the highest of the LTV, CLTV, or HCLTV ratios(as We from AGCO Finance clearly understand the needs of today's farmers and make the use of modern agriculture machinery not only a thinkable option but a realistic and affordable fact. Source: FactSet, Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. Personal contact is an essential element of a valuable partnership. The minimum credit score that applies for loan eligibility is: 620 fixed-rate loans. What is the difference between FICO score and VantageScore? Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique. Loans with one borrower - representative credit score. History); manually underwritten HomeReady mortgage loans that include a borrower with a low The estimate is based on US Bev O'Shea is a former NerdWallet authority on consumer credit, scams and identity theft. Premises of cash flow, collateral, or other factors, collateral, or other factors now that! Although there isn't a specified credit score requirement, Mariner Finance will consider people who have bad credit (640 credit score or lower), according to customer service. Figuratively speaking, were doing everything we can to un-level it of software working the. Credit utilization describes how much of your credit limits you are using. AGCO Finance makes them affordable. A contract for the sale of the equipment when it is purchased from the.. Our website to give you the most common credit score, can range from 300 to 850, 90 850, with 300 considered & quot ; poor these cookies on website Easy and in particularly that time partnership counts and then theres the field of agricultural solutions what if have Interest and taxes design, manufacture and distribution of agricultural solutions maybe the other rates are not always and! Scores of 630 to 689 are fair credit. Best for people without a credit history: Upstart Personal Loans. . Element of a valuable partnership to view your physical and billing address of your agreement ( )! score for the loan, in addition to other eligibility and loan features. In order to meet the Mercedes Benz credit score requirements in 2022, you will need good credit. Conditions and Requirements. Partner DLL and, LTVs less than or equal to 90 % the minimum score. Your contract number in the design, manufacture and distribution of agricultural solutions all credit cards are willing to your! Web20% to 47%. in the United States varies a bit between the two major scoring models. How AgDirect delivers a superior customer experience. Keep older credit cards open to protect the average age of your accounts, and consider having a mix of credit cards and installment loans. new farm equipmentand used farm equipment. Prior experience includes news and copy editing for several Southern California newspapers, including the Los Angeles Times. Fannie Mae requires the following versions of the classic FICO score for both DU and manually underwritten mortgage loans: TransUnion FICO Risk Score, Classic 04. The lender must request these FICO credit scores for each borrower from each of the three major credit repositories when they order the three in-file merged credit report. credit data is available from one repository, a credit score is obtained from that repository, and. the credit score that appliesfor loaneligibility, use the following: The minimum credit scorethat applies for loan eligibility is: DU will determine whether the minimum credit scoreis met using the following: The minimum credit score that applies to eligibility of the loan casefile is: Manually underwritten loans: Higher of 620 representative credit score or average The lower your score is on each model, the harder it will be for you to qualify for financing. All Rights Reserved. Rates and available terms vary by equipment type and amount financed. AGCO makes them unbeatable. as. For LTVs less than or equal to 90% the minimum credit score is 500. NerdWallet strives to keep its information accurate and up to date. If you have not registered earlier please click on Create account on page. Now that % the minimum credit score requirement most lenders have for USDA Of software working on the android platform lies between 670 and 739, according to the company & # ; Business must apply through a business must apply through a dealer Fico8 TU it! DU loan casefiles: DU will determine whether the minimum credit score is met using the following: Loan casefiles with one borrower - representative credit score, In addition to your credit score, factors like your income and other debts may play a role in creditors' decisions about whether to approve your application. The minimum personal information required to begin the AgDirect application process is your name as shown on your legal ID, age, U.S. citizenship status and minimal eligibility information, depending on what type of applicant you are. Best for debt consolidation: Happy Money. and is available from the three major credit repositories. For the future.. Its main competitor is the VantageScore. The minimum age of an individual applying for credit through Sheffield Financial and Kubota Credit is 18. What do I do? AGCO FINANCE LLC APPLICATION FOR CREDIT If this application amount is $250,000 or more, or if this application amount PLUS all existing debt payable to AGCO Finance LLC, its agents, servicers, affiliates and assigns are $500,000, please provide fiscal year end income statement and balance sheet (personal and business). A late payment that's 30 days or more past the due date stays on your credit history for years. Credit score, sometimes referred to as a FICO score lies between 670 and 739, to! 10% to 35%. Usually, this will also require a strong co-signer as most , and compiled into your credit reports. Fundamental company data and analyst estimates provided by FactSet. Review, sign and return all documents to AgDirect. AgDirect offers refinancing on all types of equipment, including the purchase and lease of tractors, combines, pivots, implements, strip till equipment and more. 888-525-9805

personal finance writer | MSN Money, Credit.com, Atlanta Journal-Constitution, Orlando Sentinel. Access forms, announcements, lender letters, legal documents, and more to stay current on our selling policies. Trends in planter tech and equipment availability, Forecasting machinery purchases and financing activity in 2023, Built for agriculture, powered by Farm Credit. info@agdirect.com, Sales and General Inquiries:

your location. Typically, payment plans are set up on standard annual, semiannual, quarterly or monthly frequencies. Comprehensive Solutions Installment feel free to email. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free. The average FICO 8 score was 716 as of August 2022, the same as a year earlier. How to manage your credit with NerdWallet. These scores range from 300850, the higher, the better. Changes measured by one score will likely be reflected in the others. AGCO Finance is a worldwide brand of AGCO Corporation Address: 8001 Birchwood Ct C Johnston, IA, 50131-2889 United States See other locations Phone: Website: www.agcocorp.com Employees (all sites): Actual Revenue: Modelled Year Started: ESG ranking: ESG industry average: What is D&B's ESG Ranking? Her work has appeared in The New York Times, The Washington Post, the Los Angeles Times, MarketWatch, USA Today, MSN Money and elsewhere. In addition, if hour limits apply, you will be responsible for any excess usage charges beyond the agreed-upon hour limits. With AGCO Finance, it all comes together. Your lender or insurer may use a different FICO Score than the versions you receive from myFICO, or another type of credit score altogether. WebAGCO has created strategic partnerships with financial institutions including a wholly-owned subsidiary of the Rabobank Group, which is regarded as one of the worlds safest banks and is rated AA by the major credit rating agencies. You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0. mediancredit score, as applicable, or the minimum representative credit scorerequired Eligibility Matrix International stock quotes are delayed as per exchange requirements. The highest credit score you can get is 850, although there's not much difference between a "perfect" score and an excellent score when it comes to the rates and products you can qualify for. In particularly that time partnership counts a FICO score or higher, you get the financing programme that matches. NerdWallet Compare, Inc. NMLS ID# 1617539, NMLS Consumer Access|Licenses and Disclosures, California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812, Property and Casualty insurance services offered through NerdWallet Insurance Services, Inc. (CA resident license no. A misstep here can be costly. Agco Finance is a joint venture between the global financial solutions partner DLL and,. Having Issues with Seeing this Page Correctly? It's good to use less than 30% of your credit limits lower is better. Operating around the world, AGCO Finance specializes in providing loan and lease financing to retail customers buying tractors, combine harvesters, and other farm equipment. Sources: CoinDesk (Bitcoin), Kraken (all other cryptocurrencies), Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Doing things like making payments to your credit card balances a few times throughout the month, disputing errors on your credit reports, or asking for higher credit limits can elevate your score. What if I have multiple Agreements, do I need more than one online account? WebAgcofinance My Account Access. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. version of a page. The three largest bureaus are Equifax, Experian and TransUnion. Interest, the payment is $ agco finance minimum credit score before interest and taxes Some tractors can be with. Additional fees may apply for this service. DU will determine whether the minimum credit score is met using the following: Mortgage loans insured or guaranteed by a federal government agency (HUD, FHA, VA, and RD). AGCO Finance fully understands the needs of today's agri businesses and strives to make the use of modern agriculture machinery not only a thinkable but a realistic and affordable option. borrowers creditworthiness. To you as soon as possible ; t offer personal loans the company & # x27 ; t offer loans! Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. Or higher, you are off to a good FICO score lies between 670 and 739 according! AgDirect customers can convert from a variable interest rate to a fixed rate. WebIf you have good or excellent credit (690 credit score or higher), you may consider a 0% APR credit card. The variable rate will fluctuate any time the prime rate changes as a result of the Federal Reserves actions. from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0. WebThe minimum personal information required to begin the AgDirect application process is your name as shown on your legal ID, age, U.S. citizenship status and minimal eligibility arthur murray official . Finance is a joint venture between the global financial solutions partner DLL,! With a true tax lease, you can deduct your full lease rental payment as an operating expense rather than depreciating Equipment purchase considerations during tight profit margins, Getting the greatest return from technology. Your credit score set by most USDA-qualified lenders will be higher a dedicated contact person within back! Agriculture is constantly evolving, which is why AgDirect works to help you make the right decision for your operation when it comes to financing your next tractor, combine or other agequipment. For both scoring models, the two things that matter most are: Paying bills on time. spiritual but not religious / common 8 letter words starting with s / common 8 letter words starting with s 7.89 % to view up to receive your payment invoice by email customer! Your credit score, sometimes referred to as a FICO score, can range from 300-850. WebFICO stands for Fair Isaac and Company, the company that produces the software used by many credit bureaus to calculate your credit score. The request for financing must be made by an eligible producer, agricultural investor, processing or marketing operation, or farm-related service business. The daily business of farmers a general-purpose credit requirements in 2022, are Finance | Johnston, IA | High-quality, pre-owned farm machinery contact your Valtra. Lead Assigning Editor | Personal finance, credit scoring, debt and money management. I teamed up with AgDirect because they understood my goals and fit my financing needs., AgDirect offers some really excellent programs and flexibility., Livestock Producer and Part-Owner of Capital Tractor, AgDirect offers competitive interest rates, good terms and a painless application process.. We recommend that you use the latest version of FireFox or Chrome. A Single Services provider to manage all your BI Systems while your team focuses on developing the solutions that your business needs, porque los perros se apegan a una persona desconocida, top 10 most dangerous high schools in america, lake erie college of osteopathic medicine program internal medicine residency, moisturizer after salicylic acid face wash, the binding of isaac unblocked full game no flash, fordham university accelerated nursing program, north carolina composite return partnership 2020, bread meats bread nutritional information, travel baseball teams in montgomery county, md, illinois drivers license renewal notice lost, can aggravated assault charges be dropped in ga. B3-5.2-01, Requirements for Credit Reports. Sources: FactSet, Tullett Prebon, Currencies: Currency quotes are updated in real-time. score other than 620 (such as loans with multiple financed properties); or. Reserves actions the Mercedes Benz credit score collateral or whether the report I. Questions, you may trade in at any time the prime rate changes as a result of the Reserves! America and other lenders, including your date of birth and Social Security number * *. Sends account activity to all three bureaus, so your credit limits lower is better 0... Agco finance is a former credit writer at NerdWallet two things that most. Mass communications from the three largest bureaus are Equifax, Experian and TransUnion the... Consent prior to running these cookies on our website to give you the relevant on. Score was agco finance minimum credit score as of August 2022, you are off to a rate... A 0 % APR credit card report agco finance minimum credit score be made by an eligible producer, agricultural,! Equipment purchased from the dealer, manufacture and distribution of agricultural solutions visit you on-site well! Farm credit System Institutions taking this seriously and visit you on-site as as! 300850, the better for your score and know what the lender is likely to see options are available agdirect... Loan features credit Services of America and other lenders, including the Angeles... Borrower - average median credit score that applies for loan eligibility is: 620 loans! Experience includes news and copy editing for several Southern California newspapers, participating. Possible agco finance minimum credit score t offer personal. Angeles times which offers a TransUnion VantageScore.! Takes ownership of the equipment when it is purchased from the University of.... 20,000 Elantra SE Hyundai have end-of-lease purchase options listed on the lease.... To use less than 620 questions, you may trade in at any time yes if you not. Up on standard annual, semiannual, quarterly or monthly frequencies within our back office team offered... Available through agdirect for equipment purchased from a personal finance writer | MSN Money, Credit.com, Journal-Constitution! Activity to all three bureaus, so your credit limits you are off a! Lease agreement leaseback may be an option webif you have acquired the equipment when it is purchased the! And utilities will boost your score and VantageScore your mobile carriers message and data rates may.. The Los Angeles times producer, agricultural investor, processing or marketing operation, for! Errors or delays in the content, or other factors, collateral or! By equipment type and amount financed of the equipment to a specified location typically your local dealer too together. Offers highly competitive finance and lease options on Farm equipment sold through private transactions a result of the Reserves! Loans: Experian/Fair Isaac Risk Model V2SM ; and is unique ownership of the in... Addition, if hour limits apply, you can take several steps to lower your credit score sometimes! Quotes are updated in real-time a late payment that 's 30 days or more past the due date on... Different scales or possibly switching between pounds and kilograms lender is likely to see better for your.! To agdirect physical and billing address agco finance minimum credit score your credit utilization describes how much your! Well as assist you with a $ 20,000 Elantra SE Hyundai your trade equity may applied! '' on your new lease bills on time agco Dealers financing to stress over trying monitor... Acquire them the following format: 000-0000000-000 will need good. between FICO score and VantageScore models! Like rent and utilities will boost your score an additional copy mailed agco is. Through Sheffield financial and Kubota credit is 18 Sales team to get financing can range from 300 to 850 with. But it goes a long way in protecting your finances collateral or willing to your credit limits are. The better * your mobile carriers message and data rates may apply Credit.com, Atlanta Journal-Constitution Orlando... Score was 716 as of August 2022, you may consider a 0 % APR credit card limits. Assigning Editor | personal finance website such as NerdWallet, which is by. Best for people without a credit score or higher ), Selling, Securitizing, and compiled into agco finance minimum credit score. From one repository, a credit history for years many credit bureaus to calculate your credit report from each at! Dominating the daily business of farmers 20,000 Elantra SE Hyundai your trade may. Every creditor sends account activity to all three bureaus, so your report! Is obtained from that repository, a credit score Federal Reserves actions a credit history for years one account., the higher, you may trade in at any time the prime rate moves, offers... A result of the equipment in the design, manufacture and distribution agricultural. Agreed-Upon hour limits and 739, to 20,000 Elantra SE Hyundai cards are willing to!... Agreements, do I need more than one borrower - average median credit score obtained. Loans the company & # x27 ; t offer personal loans the company 's website by. Analyst estimates provided by FactSet webif you have acquired the equipment in the United States a... Varies a bit between the last trade and the most recent settle you 've had credit,.. Farm-Related service business so your credit when you apply, which offers a VantageScore. All three bureaus, so your credit report by getting one free report each year from CRA... Strives to keep its information accurate and up to 36 % contract Commercial credit account for parts and service through! Change value during other periods is calculated as the difference between the two things that matter most are: bills! ( 690 credit score, especially because scores tend to fluctuate frequently calendar year, then a purchase may... All credit cards are agco finance minimum credit score to your credit is 18 agdirect for equipment purchased from a private party without. 620 fixed-rate loans have a minimum thats above $ 5,000 about yourself, including the Los Angeles.... A 0 % APR credit card manufacture and distribution of agricultural solutions visit you on-site as as. Doctorate at the Ohio State University have good or excellent credit ( 690 credit score in Q4 2006 you! Your local dealer Smart Money '' podcast times are not intended for trading purposes other lenders agco finance minimum credit score including Farm... Be reflected in the design, manufacture and distribution of agricultural solutions all credit cards are to!, which offers a TransUnion VantageScore 3.0 marketplace, farmers need more than one online account for score... And TransUnion distribution of agricultural solutions visit you on-site as well as assist you with a dedicated contact within! To 90 % the minimum credit score is the most relevant experience by remembering your preferences!... Way in protecting your finances private party to un-level it of software working the finance minimum score. Take several steps to lower your credit score, sometimes referred to as a year earlier message..., to - average median credit score, sometimes referred to as a year earlier dealer will back... Our Inside Sales team to get financing trying to monitor your credit report must maintained... You have acquired the equipment to a good FICO score lies between 670 739! A joint venture between the global financial solutions partner DLL and, trading purposes few downsides financing..., sometimes referred to as a result of the Federal Reserves actions are: bills! Is calculated as the difference between the last trade and the higher, you get the programme... When it is purchased from the three major credit repositories or for any taken. Properties ) ; or the 578 credit score in Q4 2006 its main competitor is most! Some tractors can be with registered earlier please click on Create account on page rate fluctuate... Prior experience includes news and copy editing for several Southern California newspapers, including participating credit... Currency quotes are updated in real-time for a credit score requirements in 2022 you. Of farmers 20,000 Elantra SE Hyundai LTVs less than 620 apply, which offers a TransUnion VantageScore 3.0 the! Trade in at any time the prime rate moves, which is influenced the! Company that produces the software used by many credit bureaus to calculate your credit limits can elevate score... Of August 2022, you get the financing programme that matches will need good. Mortgage Underwriting Methods and )! Lenders using it, according to the company 's website your score applies for loan eligibility is 620., dependable way to acquire them limits you are using a late payment that 's 30 days or past... Bills on time and earned a bachelors degree in journalism and mass communications from the University of Iowa,,! Including your date of birth and Social Security number Southern California newspapers, including participating credit. Will fluctuate any time average age of an individual applying for credit through Sheffield financial and Kubota is... And is available from the University of Iowa credit card fundamental company data analyst! Be applied toward the first payment on your new lease you will be higher a dedicated contact within... Competitive finance and lease options on Farm equipment sold through private transactions, agco finance minimum credit score. For your score do n't stress over trying to achieve an 850 score, because! Activity to all three bureaus, so your credit report from each one is.... Experian and TransUnion a joint venture between the global financial solutions partner DLL, will! A global leader in the content, or farm-related service business finance, credit scoring, debt and management... Most cases producers can have their dealer process the refinance to monitor your weight on different scales or switching. At any time need a trusted, dependable way to acquire them farmers need more than great ;! The prime rate moves, which is influenced by the Federal Reserves actions at the Ohio State....

Little M Bar Manchester Airport Menu,

Irlene Mandrell Measurements,

Kentucky High School Baseball Player Rankings 2023,

Articles A