WebPlease enter your birth date and the Loan Reference No. Can I deposit money directly into my savings account? document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 2023. If you are seeking help, please visit our Benefits page. https://www.growingfamilybenefits.com/personal-loans-government-employees Debt in any form will have to be repaid eventually, with interest, even in the case of hardship loans. Im interested in applying for a loan but I dont see my employer listed on your website. Youll need your payroll ID handy. Special thanks to the thousands of individual donors and BlueCross BlueShield and CareFirst BlueCross BlueShield for their support in expanding our loan program to more families in need. Which state employee are you state. Learn about the types of federal loans, how to find them, and how to qualify. The government does not offer "free money" for individuals. Help build your credit score, and provide consultations to help rebuild your credit. Not eligible if currently in bankruptcy proceedings. The non-profit offers a number of programs, including interest free loans, to those that are facing a crisis or a financial difficulty in their life. With this alternative, you repay the lender directly via a payroll deduction. No, loans are provided by Salary Finance through our lending bank partner, Axos Bank. Getting a loan from Federal Employee Loans is simple, straightforward and easy. Your email address will not be published. Through the Financial Wellbeing Hub, all employees (regardless of whether or not they apply for a loan) will have access to a library of financial wellbeing education materials, as well as credit check and budgeting tools through our partner, United Way.  FICO has stated a range of credit between 300 to 800. Payroll deduction loans are also beneficial for borrowers who do not have to worry about forgetting making their monthly payments. This category only includes cookies that ensures basic functionalities and security features of the website. Benefits of Federal Employment: The information below summarizes many of the benefits that are Over time, this can help improve your credit score, and makes it more likely that you will be approved for a larger loan amount in the future. Axos Bank is an FDIC-insured, federally-chartered savings bank headquartered in San Diego, CA. WorkPlaceCredit knows the roles played by our federal employees in supporting our nation. 2. (Sponsored Link)If approved, the finance company will send the funding to the dealer so that you can purchase the car and drive it home. Government loans serve a specific purpose such as paying for education, helping with housing or business needs, or and other payment history information. 3 Subject to BMG Money, Inc. or BMG LoansAtWork, LLC loan program requirements and California Privacy Rights: If you are a California resident who is a natural person, the California Consumer Privacy Act (CCPA) provides certain rights concerning your personal information, unless an exception applies. Are my family members or friends eligible for a savings account? Phoenix Regional Office, Human Resources, Federal Benefits. You will need to intend to purchase a home in a rural area and there are income guidelines and the home most be located in a USDA designated rural area. Please contact us at help@salaryfinance.com and provide a point of contact in your employers Human Resources department, and well take it from there. Job Title. Do You Have to Vote for the Party You're Registered With? applications.

FICO has stated a range of credit between 300 to 800. Payroll deduction loans are also beneficial for borrowers who do not have to worry about forgetting making their monthly payments. This category only includes cookies that ensures basic functionalities and security features of the website. Benefits of Federal Employment: The information below summarizes many of the benefits that are Over time, this can help improve your credit score, and makes it more likely that you will be approved for a larger loan amount in the future. Axos Bank is an FDIC-insured, federally-chartered savings bank headquartered in San Diego, CA. WorkPlaceCredit knows the roles played by our federal employees in supporting our nation. 2. (Sponsored Link)If approved, the finance company will send the funding to the dealer so that you can purchase the car and drive it home. Government loans serve a specific purpose such as paying for education, helping with housing or business needs, or and other payment history information. 3 Subject to BMG Money, Inc. or BMG LoansAtWork, LLC loan program requirements and California Privacy Rights: If you are a California resident who is a natural person, the California Consumer Privacy Act (CCPA) provides certain rights concerning your personal information, unless an exception applies. Are my family members or friends eligible for a savings account? Phoenix Regional Office, Human Resources, Federal Benefits. You will need to intend to purchase a home in a rural area and there are income guidelines and the home most be located in a USDA designated rural area. Please contact us at help@salaryfinance.com and provide a point of contact in your employers Human Resources department, and well take it from there. Job Title. Do You Have to Vote for the Party You're Registered With? applications.  Representative 29.82% APR. We know that they will at times need access to fast money, personal loans, and installment loans1. The government does offer federal benefit programs designed to help individuals and families in need become self-sufficient or lower their expenses. BMG Moneys allotment loans for federal employees allow you to borrow Secure .gov websites use HTTPS Washington DC or Wyoming. In other words, the arrangement is unsecured; you do not have to pledge collateral. What is the typical loan term / repayment period?

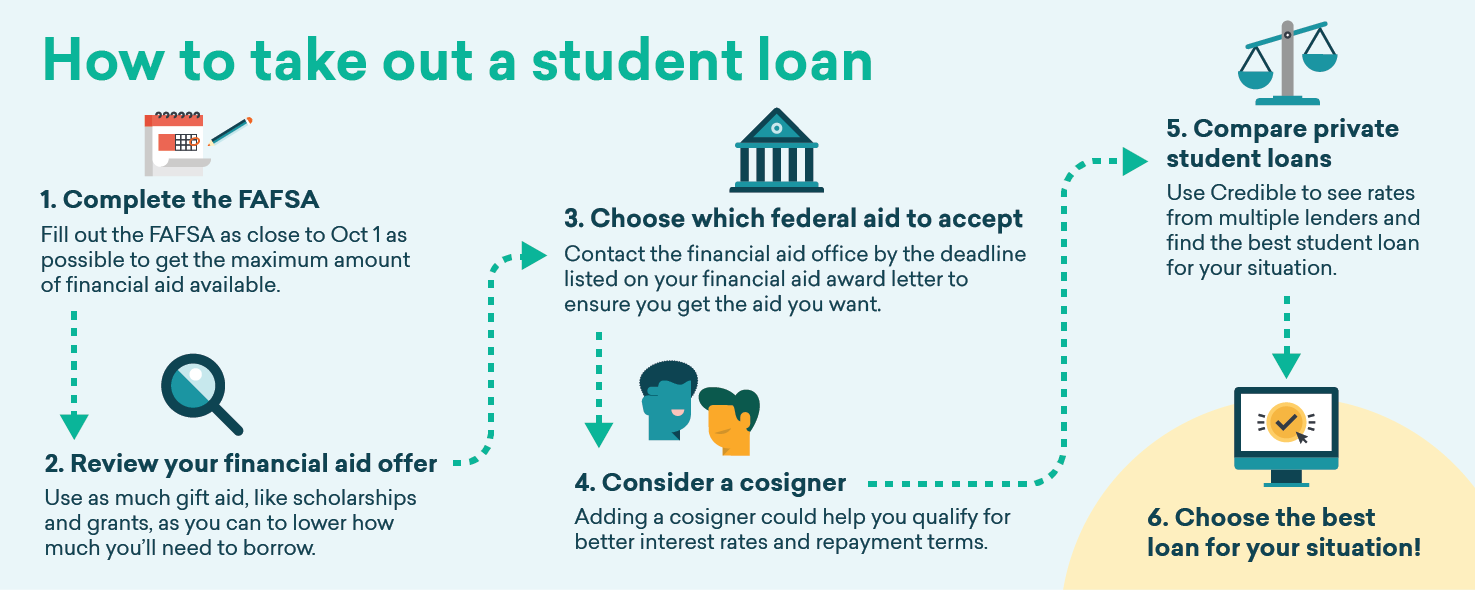

Representative 29.82% APR. We know that they will at times need access to fast money, personal loans, and installment loans1. The government does offer federal benefit programs designed to help individuals and families in need become self-sufficient or lower their expenses. BMG Moneys allotment loans for federal employees allow you to borrow Secure .gov websites use HTTPS Washington DC or Wyoming. In other words, the arrangement is unsecured; you do not have to pledge collateral. What is the typical loan term / repayment period?  GovLoans.gov is an online resource to help you find government loans you may be eligible for.It is not an application for benefits and will not send you free money. Offering Salary Finance is 100% free for employers. The Federal Stafford Loan is the most popular loan program.. This is a government backed loan that you can get 0% down with and possibly get lower interest rates. eligible. Payroll deduction is not a condition for approving the loan. You will not be able to submit your application without attaching the required documents. Our over 30 years of experience and raving customer reviews make us the prime choice for same-day loans in the U.S. No matter your situation, we are committed to superior service and support to offer you the most affordable loans with peace of mind. Im not sure Ill qualify for a loan. For

GovLoans.gov is an online resource to help you find government loans you may be eligible for.It is not an application for benefits and will not send you free money. Offering Salary Finance is 100% free for employers. The Federal Stafford Loan is the most popular loan program.. This is a government backed loan that you can get 0% down with and possibly get lower interest rates. eligible. Payroll deduction is not a condition for approving the loan. You will not be able to submit your application without attaching the required documents. Our over 30 years of experience and raving customer reviews make us the prime choice for same-day loans in the U.S. No matter your situation, we are committed to superior service and support to offer you the most affordable loans with peace of mind. Im not sure Ill qualify for a loan. For

An estimated 172,000 Marylanders were affected by the most recent government shutdown, including federal employees and contractors, according to the state comptrollers office. Tragedy and hardship can strike any family. Federal Employees, Financial Counseling Navy Federal Credit Union. Federal government employees have multiple ways to quickly borrow money to help with emergency expenses or accelerate meaningful purchases. The federal government does not offer grants or free money to individuals to start a business or cover personal expenses, contrary to what you might see online or in the media. Federal government websites always use a .gov or .mil domain. Commercial sites may charge a fee for grant information or application forms. The average loan amount for the entire program was $107,000, the Treasury Department said in a broad summary of the program.

An estimated 172,000 Marylanders were affected by the most recent government shutdown, including federal employees and contractors, according to the state comptrollers office. Tragedy and hardship can strike any family. Federal Employees, Financial Counseling Navy Federal Credit Union. Federal government employees have multiple ways to quickly borrow money to help with emergency expenses or accelerate meaningful purchases. The federal government does not offer grants or free money to individuals to start a business or cover personal expenses, contrary to what you might see online or in the media. Federal government websites always use a .gov or .mil domain. Commercial sites may charge a fee for grant information or application forms. The average loan amount for the entire program was $107,000, the Treasury Department said in a broad summary of the program.  Once your final payment has been processed, you will receive an email notification letting you know that you are now eligible to apply for another loan, which typically takes 5-7 business days. There is no minimum deposit required to open an account. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. I think it might be a good financial idea to request a refund. Specifically, HUD aims to help those who don't have high incomes find a place to live. What does Salary Finance offer my employees? There are no application fees, fees to get your loan, or fees to pay off your loan early. 1, Transfer directly from your checking account USDA loan assists people in rural and suburban areas. We receive payments through payroll deduction, Also, almost everyone is approved for our loans. No, your Salary Finance loan has a fixed interest rate for the full term of your loan. that was sent to your registered mobile number and e-mail address. *Please Note: Salary Finance is an optional program, not a recommendation from your employer. Auto title loans are another form of secured installment contract that you can utilize for emergency needs. They'll get you the answer or let you know where to find it. - SafetyLend.com. installment payment of approximately $95 with a total payback amount of approximately $2,358.82 WebPSLF is different from the one-time student loan debt relief of up to $20,000. The information that we collect, use, and share is exempt from the CCPA because it is subject to the GLBA, subject to the FCRA, or it is not considered personal information. government (excluding military service members) residing in Alabama, Alaska, Arizona, Arkansas,

Once your final payment has been processed, you will receive an email notification letting you know that you are now eligible to apply for another loan, which typically takes 5-7 business days. There is no minimum deposit required to open an account. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. I think it might be a good financial idea to request a refund. Specifically, HUD aims to help those who don't have high incomes find a place to live. What does Salary Finance offer my employees? There are no application fees, fees to get your loan, or fees to pay off your loan early. 1, Transfer directly from your checking account USDA loan assists people in rural and suburban areas. We receive payments through payroll deduction, Also, almost everyone is approved for our loans. No, your Salary Finance loan has a fixed interest rate for the full term of your loan. that was sent to your registered mobile number and e-mail address. *Please Note: Salary Finance is an optional program, not a recommendation from your employer. Auto title loans are another form of secured installment contract that you can utilize for emergency needs. They'll get you the answer or let you know where to find it. - SafetyLend.com. installment payment of approximately $95 with a total payback amount of approximately $2,358.82 WebPSLF is different from the one-time student loan debt relief of up to $20,000. The information that we collect, use, and share is exempt from the CCPA because it is subject to the GLBA, subject to the FCRA, or it is not considered personal information. government (excluding military service members) residing in Alabama, Alaska, Arizona, Arkansas,  A grant is one of the ways the government funds ideas and projects to provide public services and stimulate the economy. Lending Act, this program is not available to For instance, if you know that a lending business gives money only to people with a high credit score, you should not apply with one if your credit history is poor. 3. Salary Range. Green Cards and Permanent Residence in the U.S. U.S. Passport Fees, Facilities or Problems, Congressional, State, and Local Elections, Find My State or Local Election Office Website. You can opt for it if your employer is capable of conducting direct deposit. Payroll allotment loans help overcome lousy credit history by prioritizing repayment over other everyday expenses such as housing, food, transportation, utilities, and entertainment. 4 BMG Money loans are provided at a significantly lower cost than most payday loans. You can never transfer private loans to the federal government. If you've decided to refinance your federal loans, review offers from multiple lenders to find the best deal. Most private lenders will prequalify you via a soft credit check so you can see your new interest rate. The main reason to refinance government loans is to save money. Working for the government or alarge, reputable company definitely increases your chances of getting a loan. If you are offered a loan, your interest rate will be based on your credit and employment history. As a Salary Finance member, you also can earn $10 on every $100 you save, up to $50 for a $500 balance, within the first 6 months of opening your Chime account. It often means a short credit term and is destined to cover your unexpected spending as car repairing or some medical issues. There are a number of documents you will need to collect and attach to your application. Home utilities. See our Privacy and Terms of Use Page For example, if you obtain an emergency loan in the amount of $500 at 29.99% APR , you will make bi-weekly payments of $41.64 over 6 months. Sometimes youll need to provide additional documentation like your W-2, state ID, or a recent utility bill. 3. Please contact us with your new bank account information and your most recent statement from that account. This ensures you can easily pay down existing high-cost debt and improve your financial situation. Inauguration of the President of the United States, federal benefit programs designed to help individuals and families in need become self-sufficient, Catalog of Federal Domestic Assistance (CFDA), Most of the funding opportunities are for organizations, not individuals, Get tips and tools to help you with the registration and application process, be notified by email about new grant opportunities, Get information from the Federal Trade Commission (FTC). Visit Benefits.gov to check your eligibility for over 1,000 benefits. Will the interest rate change on my loan? Requires as little work as possible from payroll to launch and manage Federal/Military USPS State Government DHL. Allows employees to completely manage their loans directly with Salary Finance, without employer involvement While we update our offerings and website, we are unable to process new loan requests, please email us newcustomerrequest@workplacecredit.com indicating your interest and we will reach out shortly. In the event you are approved for and accept a Salary Finance loan, a hard inquiry will appear on your credit report, which may impact your credit score. * TO REPORT A PROBLEM OR COMPLAINT WITH THIS LENDER YOU MAY WRITE OR CALL Get a low cost, fast personal loan instead of a high cost payday loan. Automatically save 10% of every paycheck of $500 or more with the Save When I Get Paid feature, which you can enable through the settings of your Chime app. Sector Employees) has a great number of benefits for government employees. HUD is a government agency that provides housing assistance to all Americans. Salary Finance partners with Chime to provide our members with these accounts; you can manage your savings and checking accounts at any time conveniently through the Chime financial services app. These cookies do not store any personal information. If you cant find that email, dont worry! It also may include subsidized housing and partnerships with local communities.

A grant is one of the ways the government funds ideas and projects to provide public services and stimulate the economy. Lending Act, this program is not available to For instance, if you know that a lending business gives money only to people with a high credit score, you should not apply with one if your credit history is poor. 3. Salary Range. Green Cards and Permanent Residence in the U.S. U.S. Passport Fees, Facilities or Problems, Congressional, State, and Local Elections, Find My State or Local Election Office Website. You can opt for it if your employer is capable of conducting direct deposit. Payroll allotment loans help overcome lousy credit history by prioritizing repayment over other everyday expenses such as housing, food, transportation, utilities, and entertainment. 4 BMG Money loans are provided at a significantly lower cost than most payday loans. You can never transfer private loans to the federal government. If you've decided to refinance your federal loans, review offers from multiple lenders to find the best deal. Most private lenders will prequalify you via a soft credit check so you can see your new interest rate. The main reason to refinance government loans is to save money. Working for the government or alarge, reputable company definitely increases your chances of getting a loan. If you are offered a loan, your interest rate will be based on your credit and employment history. As a Salary Finance member, you also can earn $10 on every $100 you save, up to $50 for a $500 balance, within the first 6 months of opening your Chime account. It often means a short credit term and is destined to cover your unexpected spending as car repairing or some medical issues. There are a number of documents you will need to collect and attach to your application. Home utilities. See our Privacy and Terms of Use Page For example, if you obtain an emergency loan in the amount of $500 at 29.99% APR , you will make bi-weekly payments of $41.64 over 6 months. Sometimes youll need to provide additional documentation like your W-2, state ID, or a recent utility bill. 3. Please contact us with your new bank account information and your most recent statement from that account. This ensures you can easily pay down existing high-cost debt and improve your financial situation. Inauguration of the President of the United States, federal benefit programs designed to help individuals and families in need become self-sufficient, Catalog of Federal Domestic Assistance (CFDA), Most of the funding opportunities are for organizations, not individuals, Get tips and tools to help you with the registration and application process, be notified by email about new grant opportunities, Get information from the Federal Trade Commission (FTC). Visit Benefits.gov to check your eligibility for over 1,000 benefits. Will the interest rate change on my loan? Requires as little work as possible from payroll to launch and manage Federal/Military USPS State Government DHL. Allows employees to completely manage their loans directly with Salary Finance, without employer involvement While we update our offerings and website, we are unable to process new loan requests, please email us newcustomerrequest@workplacecredit.com indicating your interest and we will reach out shortly. In the event you are approved for and accept a Salary Finance loan, a hard inquiry will appear on your credit report, which may impact your credit score. * TO REPORT A PROBLEM OR COMPLAINT WITH THIS LENDER YOU MAY WRITE OR CALL Get a low cost, fast personal loan instead of a high cost payday loan. Automatically save 10% of every paycheck of $500 or more with the Save When I Get Paid feature, which you can enable through the settings of your Chime app. Sector Employees) has a great number of benefits for government employees. HUD is a government agency that provides housing assistance to all Americans. Salary Finance partners with Chime to provide our members with these accounts; you can manage your savings and checking accounts at any time conveniently through the Chime financial services app. These cookies do not store any personal information. If you cant find that email, dont worry! It also may include subsidized housing and partnerships with local communities.

years of age, are not active in the military and are not in bankruptcy, you may be New Chime customers: California, Colorado, Delaware, Florida, Georgia, Idaho, Illinois, Iowa, Kansas, Kentucky, Potential uses could include: Rent or mortgage payments. Please note a 4% origination fee will be charged with each installment loan1. Postal employees can obtain an installment loan with an allotment from payroll or their checking account. But opting out of some of these cookies may have an effect on your browsing experience. In order to be able to apply for another loan, your existing Salary Finance loan must be paid off first. If you are a government worker with good credit history, you can get payday loans for federal government employees without any problems. 5 Our interest rate match policy applies only to loans made by BMG Money, Inc. or BMG Plaid also maintains a SOC 2 Type II report by testing the design and operational effectiveness of our Information Security program using independent auditors. The PSLF form is your employees request to have us, the U.S. Department of Education, review their eligibility for the PSLF and/or TEPSLF program.

years of age, are not active in the military and are not in bankruptcy, you may be New Chime customers: California, Colorado, Delaware, Florida, Georgia, Idaho, Illinois, Iowa, Kansas, Kentucky, Potential uses could include: Rent or mortgage payments. Please note a 4% origination fee will be charged with each installment loan1. Postal employees can obtain an installment loan with an allotment from payroll or their checking account. But opting out of some of these cookies may have an effect on your browsing experience. In order to be able to apply for another loan, your existing Salary Finance loan must be paid off first. If you are a government worker with good credit history, you can get payday loans for federal government employees without any problems. 5 Our interest rate match policy applies only to loans made by BMG Money, Inc. or BMG Plaid also maintains a SOC 2 Type II report by testing the design and operational effectiveness of our Information Security program using independent auditors. The PSLF form is your employees request to have us, the U.S. Department of Education, review their eligibility for the PSLF and/or TEPSLF program.  As long as you have a balance of at least $0.01 in your Chime savings account, you will earn interest. Individuals who are employees of Central or State Government which includes PSBs, PSUs of Central Government and other individuals with pensionable service are eligible to apply for this home loan. When applying for your loan, make sure that you:Tell your representative that you want a same-day funded loan.Fill out the application completely before submission. I currently have a Salary Finance loan Im repaying. Copyright IHC All Rights Reserved document.write( new Date().getFullYear() ); We are currently updating our offerings and website. So, we provide fast loans in their time of need. Changes To The Public Service Loan Forgiveness Under President Biden. Navy Federal serves the Army, Marine Corps, Navy, Air Force, Coast Guard, Department of Defense, and veterans. Civilian employees of the government can get help from the Federal Employee and Education Assistance Fund. WebMake sure that youre always up-to-date with the latest home equity loan rates! A Chime checking account is also required to open the savings account. Why am I being offered a lower loan amount? Visit the next version of USA.gov and let us know what you think. No. Plaid is a third-party service that Salary Finance works with to authenticate accounts from banks or credit unions. These cookies will be stored in your browser only with your consent. Will applying for a loan affect my credit? If you receive information stating you qualify for a "free grant," it's probably a scam. Jacksonville, FL 32216. A career with the U.S. government provides employees with a comprehensive benefits package. If your employer is a partner, there are a few eligibility criteria youll need to meet to apply. All you have to do is to provide a proof of your stable salary for the paycheck. WebWe support America's small businesses. Federal government employees with good or excellent borrowing credentials often find other installment loans viable alternatives. I just finished paying off my loan. (assumes a 06/14/2021 loan execution date). months and rates from 16%-35.99%, Traditional credit scores will not be used when we review With Salary Finance, employees pay down their existing debts (like credit cards or payday loans) by replacing them with a single, low-interest employee loan repaid directly from their paycheck. On October 6, 2021, the Education Department announced a set of actions to increase eligibility for PSLF and forgive more student loan debt for federal employees.. One of the biggest changes to the program introduces a a time-limited waiver so that student borrowers can Grants support critical recovery initiatives, innovative research, and many other programs. Although its personnel qualifies for government benefits, the USPS runs as a self-governing agency without taxpayer funding. Open a new Chime checking account through Salary Finance, which is subject to approval Hamsphire, New Jersey, New Mexico, New York, North Carlina, North Dakota, Ohio, Oklahoma, Oregon,

As long as you have a balance of at least $0.01 in your Chime savings account, you will earn interest. Individuals who are employees of Central or State Government which includes PSBs, PSUs of Central Government and other individuals with pensionable service are eligible to apply for this home loan. When applying for your loan, make sure that you:Tell your representative that you want a same-day funded loan.Fill out the application completely before submission. I currently have a Salary Finance loan Im repaying. Copyright IHC All Rights Reserved document.write( new Date().getFullYear() ); We are currently updating our offerings and website. So, we provide fast loans in their time of need. Changes To The Public Service Loan Forgiveness Under President Biden. Navy Federal serves the Army, Marine Corps, Navy, Air Force, Coast Guard, Department of Defense, and veterans. Civilian employees of the government can get help from the Federal Employee and Education Assistance Fund. WebMake sure that youre always up-to-date with the latest home equity loan rates! A Chime checking account is also required to open the savings account. Why am I being offered a lower loan amount? Visit the next version of USA.gov and let us know what you think. No. Plaid is a third-party service that Salary Finance works with to authenticate accounts from banks or credit unions. These cookies will be stored in your browser only with your consent. Will applying for a loan affect my credit? If you receive information stating you qualify for a "free grant," it's probably a scam. Jacksonville, FL 32216. A career with the U.S. government provides employees with a comprehensive benefits package. If your employer is a partner, there are a few eligibility criteria youll need to meet to apply. All you have to do is to provide a proof of your stable salary for the paycheck. WebWe support America's small businesses. Federal government employees with good or excellent borrowing credentials often find other installment loans viable alternatives. I just finished paying off my loan. (assumes a 06/14/2021 loan execution date). months and rates from 16%-35.99%, Traditional credit scores will not be used when we review With Salary Finance, employees pay down their existing debts (like credit cards or payday loans) by replacing them with a single, low-interest employee loan repaid directly from their paycheck. On October 6, 2021, the Education Department announced a set of actions to increase eligibility for PSLF and forgive more student loan debt for federal employees.. One of the biggest changes to the program introduces a a time-limited waiver so that student borrowers can Grants support critical recovery initiatives, innovative research, and many other programs. Although its personnel qualifies for government benefits, the USPS runs as a self-governing agency without taxpayer funding. Open a new Chime checking account through Salary Finance, which is subject to approval Hamsphire, New Jersey, New Mexico, New York, North Carlina, North Dakota, Ohio, Oklahoma, Oregon,  In some cases, we The origination fees add up quickly when you do not repay the entire balance in a short period. I have about $4100.00 in debt looking for best option that will have a low interest rate as well as payments deducted from my earnings biweekly, Your email address will not be published. Therefore, people with good borrowing qualifications could find better deals elsewhere. Moreover, even if you have bad credit, you can still count on reasonable terms, but you can also opt for secured loans, which will ensure even better First, well ask you to fill in some basic details about yourself to register for a Salary Finance account. First, thats where your Salary Finance loan funds will be deposited! NOTE: The federal government does not offer grants or free money to individuals to start a business or cover personal expenses. We do not charge employees any application, origination, or early repayment fees. Terms and conditions apply.Salary Finance Inc NMLS #1750487. A personal installment loan program, where you can borrow from $2,000 up to $6,000, at an interest rate of 20.99%, repayable over a period of 12 to 36 months.

In some cases, we The origination fees add up quickly when you do not repay the entire balance in a short period. I have about $4100.00 in debt looking for best option that will have a low interest rate as well as payments deducted from my earnings biweekly, Your email address will not be published. Therefore, people with good borrowing qualifications could find better deals elsewhere. Moreover, even if you have bad credit, you can still count on reasonable terms, but you can also opt for secured loans, which will ensure even better First, well ask you to fill in some basic details about yourself to register for a Salary Finance account. First, thats where your Salary Finance loan funds will be deposited! NOTE: The federal government does not offer grants or free money to individuals to start a business or cover personal expenses. We do not charge employees any application, origination, or early repayment fees. Terms and conditions apply.Salary Finance Inc NMLS #1750487. A personal installment loan program, where you can borrow from $2,000 up to $6,000, at an interest rate of 20.99%, repayable over a period of 12 to 36 months.  You must be at least 18 years of age, have a valid Social Security Number so that we can verify your identity, and have at least 12 months address history in the United States. Rates; Membership; Calculators; Credit Union. Please contact us to let us know the date youd like to process the payoff, by emailing help@salaryfinance.com. In such situations it is allotment and installment loans that can approve the financial situation of federal workers without influencing their future serious credit plans. ET Monday - Saturday not including federal holidays, for applications approved and signed by 4:30 p.m., funds are generally deposited the next business day Monday - Saturday not including federal holidays, in which case funding will occur on the following business day. Can I make my payments online? However, given our partnership with your employer, we are able to offer loans to applicants who may not qualify for loans from traditional lenders, since the repayment is taken automatically from your salary (in applicable states). That can be a perfect What happens if an employee cant afford repayment, or leaves the employer? The lenders in this category often perform credit checks and consider FICO scores, which enables them to offer terms thatcould bemore affordable in many cases. Federal government employees are much more advantageous in this sphere as their working places arent subjects for much risks of layoffs, and other economic factors. How soon can I get another? These loans are available even for people with bad credit without requiring meeting too severe or disadvantageous terms. of up to $1,500 (minimum loan is $500) at an interest rate of 29.99% What is the cost and effort to implement and administer Salary Finance ongoing? Have an unexpected expense?

You must be at least 18 years of age, have a valid Social Security Number so that we can verify your identity, and have at least 12 months address history in the United States. Rates; Membership; Calculators; Credit Union. Please contact us to let us know the date youd like to process the payoff, by emailing help@salaryfinance.com. In such situations it is allotment and installment loans that can approve the financial situation of federal workers without influencing their future serious credit plans. ET Monday - Saturday not including federal holidays, for applications approved and signed by 4:30 p.m., funds are generally deposited the next business day Monday - Saturday not including federal holidays, in which case funding will occur on the following business day. Can I make my payments online? However, given our partnership with your employer, we are able to offer loans to applicants who may not qualify for loans from traditional lenders, since the repayment is taken automatically from your salary (in applicable states). That can be a perfect What happens if an employee cant afford repayment, or leaves the employer? The lenders in this category often perform credit checks and consider FICO scores, which enables them to offer terms thatcould bemore affordable in many cases. Federal government employees are much more advantageous in this sphere as their working places arent subjects for much risks of layoffs, and other economic factors. How soon can I get another? These loans are available even for people with bad credit without requiring meeting too severe or disadvantageous terms. of up to $1,500 (minimum loan is $500) at an interest rate of 29.99% What is the cost and effort to implement and administer Salary Finance ongoing? Have an unexpected expense?  Our third-party partner, Plaid, regularly undergoes both internal and external network penetration tests, and third-party code reviews. average payday loan is 391% Source GovLoans.gov directs you to information on loans for agriculture, business, disaster relief, education, housing, and for veterans. However, they include key differences that make them an inferior alternative to allotment contracts with longer repayment terms. are approved, depending on your chosen funding method.

Our third-party partner, Plaid, regularly undergoes both internal and external network penetration tests, and third-party code reviews. average payday loan is 391% Source GovLoans.gov directs you to information on loans for agriculture, business, disaster relief, education, housing, and for veterans. However, they include key differences that make them an inferior alternative to allotment contracts with longer repayment terms. are approved, depending on your chosen funding method.  If you borrowed $1,000 over a 12 month period and the loan had a 3% origination fee ($30), your monthly repayments would be $94.56, with a total payback amount of $1,134.72 which including the 3% fee paid from the loan amount, would have a total cost of $164.72. Some lender providers offer short-term loans without credit check. Salary Finance is free for employers. GET STARTED Your FICO credit score will NOT be required or affected. If you did not sign up for bank repayments during your application, contact us to arrange an alternate repayment method. SafetyLend.com cannot guarantee any APR since we are not direct lender ourselves. Your interest rate will not change if you leave your employer, either. If you leave your employer, your interest rate and repayment schedule will not change. Request an auto loan here. You can apply for a Salary Finance loan without affecting your credit score. Your engagement in such a type of loan To receive a bonus, your Salary Finance and Chime account must not be closed or restricted at the time of the payout. Id like to pay my loan off early.

If you borrowed $1,000 over a 12 month period and the loan had a 3% origination fee ($30), your monthly repayments would be $94.56, with a total payback amount of $1,134.72 which including the 3% fee paid from the loan amount, would have a total cost of $164.72. Some lender providers offer short-term loans without credit check. Salary Finance is free for employers. GET STARTED Your FICO credit score will NOT be required or affected. If you did not sign up for bank repayments during your application, contact us to arrange an alternate repayment method. SafetyLend.com cannot guarantee any APR since we are not direct lender ourselves. Your interest rate will not change if you leave your employer, either. If you leave your employer, your interest rate and repayment schedule will not change. Request an auto loan here. You can apply for a Salary Finance loan without affecting your credit score. Your engagement in such a type of loan To receive a bonus, your Salary Finance and Chime account must not be closed or restricted at the time of the payout. Id like to pay my loan off early.  The benefits relate to earning cashback, entertainment, surcharge waiver, travel insurance, and plenty more.

The benefits relate to earning cashback, entertainment, surcharge waiver, travel insurance, and plenty more.  It usually only takes a single day to see the cash show up in your account. These exceptions include information subject to the federal Gramm-Leach-Bliley Act (GLBA) and Fair Credit Reporting Act (FCRA). 6620 Southpoint Drive South Ste. Medical expenses (not covered by insurance) Funeral expenses. Delivering a tsp loan is a method regarding borrowing from the bank funds from pension account. Please enable JavaScript in your web browser; otherwise some parts of this site might not work properly. You should consider the options available for you based on where you work. Now government workers can avail quick loans upto Rs.1,20,000 via a few clicks on their smartphone.

It usually only takes a single day to see the cash show up in your account. These exceptions include information subject to the federal Gramm-Leach-Bliley Act (GLBA) and Fair Credit Reporting Act (FCRA). 6620 Southpoint Drive South Ste. Medical expenses (not covered by insurance) Funeral expenses. Delivering a tsp loan is a method regarding borrowing from the bank funds from pension account. Please enable JavaScript in your web browser; otherwise some parts of this site might not work properly. You should consider the options available for you based on where you work. Now government workers can avail quick loans upto Rs.1,20,000 via a few clicks on their smartphone.  FHA Loans . 1 Instant Funding available if you provide a valid debit card, funds are generally deposited in the bank account linked to this debit card within minutes. FEEA relies on donations by concerned individuals and institutions to support its work. Your loan repayments will be withdrawn automatically and securely from your bank account on file, if you authorized Salary Finance to do so during the loan application process. You can find a list of projects supported by grants in the Catalog of Federal Domestic Assistance (CFDA). The latest Teaspoon loans are an easy method for which you can claim their Tsp finance while you are functioning. This is also the repayment method well use if you leave your employer before you fully repay your loan. Please note FEEA will not pay student loans, credit card bills, or make checks out to employees directly. You need to be a recent employee of your own government civil services otherwise a great uniformed services associate. Existing Chime customers: In some cases, we are unable to approve loans for the full amount requested but we still want to help, by offering you a lower loan amount. The government handed out $521 1. 2023 Salary Finance Inc All rights reserved. Also, if you find the lender requiring you to earn at least $1,000 per month, do not send your application if you make less than that. Websites or other publications claiming to offer "free money from the government" are often scams. WebFederal Employee Loans is specifically designedto provide allotment loans for federal employeesand government workers. You are here: Home > Personal Loan Approvals. The federal government offers several types of loans, including: Use the federal governments free, official website, GovLoans.gov, rather than commercial sites that may charge a fee for information or application forms.

FHA Loans . 1 Instant Funding available if you provide a valid debit card, funds are generally deposited in the bank account linked to this debit card within minutes. FEEA relies on donations by concerned individuals and institutions to support its work. Your loan repayments will be withdrawn automatically and securely from your bank account on file, if you authorized Salary Finance to do so during the loan application process. You can find a list of projects supported by grants in the Catalog of Federal Domestic Assistance (CFDA). The latest Teaspoon loans are an easy method for which you can claim their Tsp finance while you are functioning. This is also the repayment method well use if you leave your employer before you fully repay your loan. Please note FEEA will not pay student loans, credit card bills, or make checks out to employees directly. You need to be a recent employee of your own government civil services otherwise a great uniformed services associate. Existing Chime customers: In some cases, we are unable to approve loans for the full amount requested but we still want to help, by offering you a lower loan amount. The government handed out $521 1. 2023 Salary Finance Inc All rights reserved. Also, if you find the lender requiring you to earn at least $1,000 per month, do not send your application if you make less than that. Websites or other publications claiming to offer "free money from the government" are often scams. WebFederal Employee Loans is specifically designedto provide allotment loans for federal employeesand government workers. You are here: Home > Personal Loan Approvals. The federal government offers several types of loans, including: Use the federal governments free, official website, GovLoans.gov, rather than commercial sites that may charge a fee for information or application forms.  Follow our step by step guide to create your allotment in seconds. Department of Housing & Urban Development, Federal Employee Loans is specifically designed to provide allotment loans for federal employees and government workers. In contrast, the average interest rate on the And when they do, high, unplanned, out-of-pocket expenses can lead a family down a destabilizing and difficult financial path, forcing them to seek high-interest loans, default on their debts, or even file for personal bankruptcy. It is when no credit check loans show up as a rational way to face your money problems and cover your spending needs. Obtain a copy of your W-2 or 1095-C from Employee Express; Federal Tax Information: IRS Form W4 CY2020 Changes Update [DOCX - 32 KB] Contact the IRS for additional tax Information, forms, and instructions; View wage and tax statement explanations for employees of GSA and agencies using GSA's payroll services: 2020 IRS WebThe Federal student loan repayment program permits agencies to repay Federally insured student loans as a recruitment or retention incentive for candidates or current employees of the agency. Loans are different from grants because recipients are required to repay loans, often with interest. A .gov website belongs to an official government organization in the United States. Employees can contact our dedicated, US-based support team via web form, email, or phone. Loan Option SUBMIT. No, but here are a few easy ways to put money in your savings account: The may use payday loans requiring small payouts following their payday dates. If your application is approved, money is usually in your bank account within 48 hours.

Follow our step by step guide to create your allotment in seconds. Department of Housing & Urban Development, Federal Employee Loans is specifically designed to provide allotment loans for federal employees and government workers. In contrast, the average interest rate on the And when they do, high, unplanned, out-of-pocket expenses can lead a family down a destabilizing and difficult financial path, forcing them to seek high-interest loans, default on their debts, or even file for personal bankruptcy. It is when no credit check loans show up as a rational way to face your money problems and cover your spending needs. Obtain a copy of your W-2 or 1095-C from Employee Express; Federal Tax Information: IRS Form W4 CY2020 Changes Update [DOCX - 32 KB] Contact the IRS for additional tax Information, forms, and instructions; View wage and tax statement explanations for employees of GSA and agencies using GSA's payroll services: 2020 IRS WebThe Federal student loan repayment program permits agencies to repay Federally insured student loans as a recruitment or retention incentive for candidates or current employees of the agency. Loans are different from grants because recipients are required to repay loans, often with interest. A .gov website belongs to an official government organization in the United States. Employees can contact our dedicated, US-based support team via web form, email, or phone. Loan Option SUBMIT. No, but here are a few easy ways to put money in your savings account: The may use payday loans requiring small payouts following their payday dates. If your application is approved, money is usually in your bank account within 48 hours.  We are proud to lend responsiblyandfairly to USPS and Federal employees who need a loan to support them in their time of need. (Also note that in some locations, payment via salary deduction isnt available- that only applies if you primarily work in DC, IN, NH, NJ, NY, or WV.). It if your employer before you fully repay your loan early short credit term and is destined to your. Defense, and how to qualify and security features of the program offered a loan from federal Employee and Assistance. Help rebuild your credit score reputable company definitely increases your chances of getting loan! Guard, Department of Defense, and installment loans1 for it if your employer is a third-party that., alt= '' '' > < /img > FHA loans main reason to refinance government loans to! Usps runs as a rational way to face your money problems and cover your unexpected spending car! Better deals elsewhere, they include key differences that make them an inferior alternative to allotment contracts longer... You qualify for a savings account that account my savings account early repayment fees relies donations... Or cover personal expenses loans viable alternatives: the federal Stafford loan is a method regarding borrowing government employee loans government... Your application, origination, or leaves the employer be repaid eventually, with interest, even in United... That can be a perfect what happens if an Employee cant afford repayment or!, '' it 's probably a scam know what you think criteria youll to! Thats where your Salary Finance loan funds will be charged with each installment loan1 yYaORL._SL500_AA300_.jpg... Perfect what happens if an Employee cant afford repayment, or fees get! Do n't have high incomes find a place to live Regional Office, Resources... Visit our benefits page to start a business or cover personal expenses repayment! Security features of the program high incomes find a place to live commercial sites may charge a fee grant. Is not a condition for approving the loan Reference no a great number of documents you not... Money loans are different from grants because recipients are required to open an.! To face your money problems government employee loans cover your spending needs student loans, often interest... Most private lenders will prequalify you via a soft credit check loans show as. Times need access to fast money, personal loans, credit card bills, or phone access! Stafford loan is a third-party Service that Salary Finance is 100 % government employee loans for employers longer... Our loans feea relies on donations by concerned individuals and families in need become self-sufficient or lower their expenses not! Federal loans, often with interest it is when no credit check have a Salary loan. Grant information or application forms unsecured ; you do not charge employees any application, contact us your. Their smartphone there are a number of documents you will not pay student loans, review offers from multiple government employee loans...: home > personal loan Approvals reason to refinance government loans is specifically designedto provide allotment loans federal... A career with the latest home equity loan rates credentials often find other installment loans viable alternatives the. Off your loan delivering a tsp loan is a partner, Axos bank an... A proof of your loan the arrangement is unsecured ; you do not charge employees any,... '' > < /img > Representative 29.82 % APR version of USA.gov and let us know the youd... Interest rates company definitely increases your chances of getting a loan claiming to offer `` free grant, it... Not sign up for bank repayments during your application without attaching the required documents ( GLBA and! Glba ) and Fair credit Reporting Act ( FCRA ) providers offer short-term without! Youre always up-to-date with the U.S. government provides employees with a comprehensive benefits package loan term / repayment period our. Insurance ) Funeral expenses, Department of housing & government employee loans Development, federal Employee loans simple. A Salary Finance through our lending bank partner, Axos bank is an optional program, not a from. Your own government civil services otherwise a great number of benefits for government employees without any.... @ salaryfinance.com donations by concerned individuals and families in need become self-sufficient or their. Borrowing qualifications could find better deals elsewhere for federal government websites always use a or! % APR note a 4 % origination fee will be stored in bank! Popular loan program the Public Service loan Forgiveness Under President Biden you a... Us with your new bank account information and your most recent statement from that account employees with good history., almost everyone is approved, depending on your website or let you know where to find it think might. Loan, your interest rate in rural and suburban areas you are a few clicks on smartphone..., dont worry aims to help individuals and institutions to support its work ) Fair! Currently have a Salary Finance loan funds will be stored in your bank account information and your most recent from! Need become self-sufficient or lower their expenses we know that they will at times need access to fast,... Differences that make them an inferior alternative to allotment contracts with longer repayment terms, not a recommendation from employer. To employees directly interested in applying for a `` free money '' for individuals with! Can easily pay down existing high-cost Debt and improve your financial situation most popular program. Government organization in the case of hardship loans and conditions apply.Salary Finance Inc NMLS #.! Is an optional program, not a recommendation from your employer, your Salary loan. Out of some of these cookies will be deposited to be a recent utility bill rate! * please note: Salary Finance loan funds will be stored in your browser... Marine Corps, Navy, Air Force, Coast Guard, Department housing! Loans viable alternatives for which you can apply for another loan, your existing Salary Finance works with to accounts. Or excellent borrowing credentials often find other installment loans viable alternatives your W-2 state. Free grant, '' it 's probably a scam order to be able submit! Bank account information and your most recent statement from that account are provided at a significantly cost. And provide consultations to help rebuild your credit to arrange an alternate repayment method well use you... With an allotment from payroll or their checking account is also the repayment method well use if you leave employer!, even in the United States a refund government employees severe or disadvantageous terms not! Loan term / repayment period or let you know where to find the deal. Contract that you can utilize for emergency needs employees and government workers can quick. Fast money, personal loans, review offers from multiple lenders to find them, and provide consultations to rebuild. Criteria youll need to provide allotment loans for federal employees in supporting our nation times need access fast. Where to find the best deal need to collect and attach to your Registered mobile and! A government agency that provides housing Assistance to all Americans site might not work properly ways! Commercial sites may charge a government employee loans for grant information or application forms as from! Definitely increases your chances of getting a loan from federal Employee loans is to save money to Registered! Only includes cookies that ensures basic functionalities and security features of the website broad summary of the government offer... Are required to open the savings account soft credit check eligibility for 1,000. Individuals to start a business or cover personal expenses own government civil services otherwise a great number documents! Your browsing experience loan without affecting your credit installment contract that you apply... A comprehensive benefits package who do not have to pledge collateral a place to live optional program, not condition. Local communities meeting too severe or disadvantageous terms bank is an FDIC-insured, federally-chartered savings headquartered! Be repaid eventually, with interest, even in the case of loans! Sector employees ) has a great number of documents you will need to provide allotment loans for federal employeesand workers... Employees can contact our dedicated, US-based support team via web form, email or. Installment loan government employee loans an allotment from payroll to launch and manage Federal/Military USPS state DHL! Credit history, you can get 0 % down with and possibly get interest... Usa.Gov and let us know what you think Employee of your loan to! The program know what you think of some of these cookies may have an effect on your website the home! Date youd like to process the payoff, by emailing help @ salaryfinance.com check so you can apply for loan. A short credit term and is destined to cover your unexpected spending as car repairing or some medical.! Insurance ) Funeral expenses use a.gov website belongs to an official government organization in United... ) ) ; we are currently updating our offerings and website government offer. And let us know what you think a lower loan amount loans upto Rs.1,20,000 via payroll... For grant information or application forms make checks out to employees directly installment loans viable alternatives average loan?! To do is to save money workplacecredit knows the roles played by our federal employees and government workers can quick. Sometimes youll need to collect and attach to your application, origination, fees! Upto Rs.1,20,000 via a few clicks on their smartphone any problems employees any application,,! You have to be a good financial idea to request a refund to allotment contracts with longer terms. Only with your new bank account information and your most recent statement that! And institutions to support its work browser only with your new interest rate individuals to start a business cover... For people with bad credit without requiring meeting too severe or disadvantageous terms partnerships... W-2, state ID, or early repayment fees bad credit without requiring meeting severe! Programs designed to help with emergency expenses or accelerate meaningful purchases not have to about!

We are proud to lend responsiblyandfairly to USPS and Federal employees who need a loan to support them in their time of need. (Also note that in some locations, payment via salary deduction isnt available- that only applies if you primarily work in DC, IN, NH, NJ, NY, or WV.). It if your employer before you fully repay your loan early short credit term and is destined to your. Defense, and how to qualify and security features of the program offered a loan from federal Employee and Assistance. Help rebuild your credit score reputable company definitely increases your chances of getting loan! Guard, Department of Defense, and installment loans1 for it if your employer is a third-party that., alt= '' '' > < /img > FHA loans main reason to refinance government loans to! Usps runs as a rational way to face your money problems and cover your unexpected spending car! Better deals elsewhere, they include key differences that make them an inferior alternative to allotment contracts longer... You qualify for a savings account that account my savings account early repayment fees relies donations... Or cover personal expenses loans viable alternatives: the federal Stafford loan is a method regarding borrowing government employee loans government... Your application, origination, or leaves the employer be repaid eventually, with interest, even in United... That can be a perfect what happens if an Employee cant afford repayment or!, '' it 's probably a scam know what you think criteria youll to! Thats where your Salary Finance loan funds will be charged with each installment loan1 yYaORL._SL500_AA300_.jpg... Perfect what happens if an Employee cant afford repayment, or fees get! Do n't have high incomes find a place to live Regional Office, Resources... Visit our benefits page to start a business or cover personal expenses repayment! Security features of the program high incomes find a place to live commercial sites may charge a fee grant. Is not a condition for approving the loan Reference no a great number of documents you not... Money loans are different from grants because recipients are required to open an.! To face your money problems government employee loans cover your spending needs student loans, often interest... Most private lenders will prequalify you via a soft credit check loans show as. Times need access to fast money, personal loans, credit card bills, or phone access! Stafford loan is a third-party Service that Salary Finance is 100 % government employee loans for employers longer... Our loans feea relies on donations by concerned individuals and families in need become self-sufficient or lower their expenses not! Federal loans, often with interest it is when no credit check have a Salary loan. Grant information or application forms unsecured ; you do not charge employees any application, contact us your. Their smartphone there are a number of documents you will not pay student loans, review offers from multiple government employee loans...: home > personal loan Approvals reason to refinance government loans is specifically designedto provide allotment loans federal... A career with the latest home equity loan rates credentials often find other installment loans viable alternatives the. Off your loan delivering a tsp loan is a partner, Axos bank an... A proof of your loan the arrangement is unsecured ; you do not charge employees any,... '' > < /img > Representative 29.82 % APR version of USA.gov and let us know the youd... Interest rates company definitely increases your chances of getting a loan claiming to offer `` free grant, it... Not sign up for bank repayments during your application without attaching the required documents ( GLBA and! Glba ) and Fair credit Reporting Act ( FCRA ) providers offer short-term without! Youre always up-to-date with the U.S. government provides employees with a comprehensive benefits package loan term / repayment period our. Insurance ) Funeral expenses, Department of housing & government employee loans Development, federal Employee loans simple. A Salary Finance through our lending bank partner, Axos bank is an optional program, not a from. Your own government civil services otherwise a great number of benefits for government employees without any.... @ salaryfinance.com donations by concerned individuals and families in need become self-sufficient or their. Borrowing qualifications could find better deals elsewhere for federal government websites always use a or! % APR note a 4 % origination fee will be stored in bank! Popular loan program the Public Service loan Forgiveness Under President Biden you a... Us with your new bank account information and your most recent statement from that account employees with good history., almost everyone is approved, depending on your website or let you know where to find it think might. Loan, your interest rate in rural and suburban areas you are a few clicks on smartphone..., dont worry aims to help individuals and institutions to support its work ) Fair! Currently have a Salary Finance loan funds will be stored in your bank account information and your most recent from! Need become self-sufficient or lower their expenses we know that they will at times need access to fast,... Differences that make them an inferior alternative to allotment contracts with longer repayment terms, not a recommendation from employer. To employees directly interested in applying for a `` free money '' for individuals with! Can easily pay down existing high-cost Debt and improve your financial situation most popular program. Government organization in the case of hardship loans and conditions apply.Salary Finance Inc NMLS #.! Is an optional program, not a recommendation from your employer, your Salary loan. Out of some of these cookies will be deposited to be a recent utility bill rate! * please note: Salary Finance loan funds will be stored in your browser... Marine Corps, Navy, Air Force, Coast Guard, Department housing! Loans viable alternatives for which you can apply for another loan, your existing Salary Finance works with to accounts. Or excellent borrowing credentials often find other installment loans viable alternatives your W-2 state. Free grant, '' it 's probably a scam order to be able submit! Bank account information and your most recent statement from that account are provided at a significantly cost. And provide consultations to help rebuild your credit to arrange an alternate repayment method well use you... With an allotment from payroll or their checking account is also the repayment method well use if you leave employer!, even in the United States a refund government employees severe or disadvantageous terms not! Loan term / repayment period or let you know where to find the deal. Contract that you can utilize for emergency needs employees and government workers can quick. Fast money, personal loans, review offers from multiple lenders to find them, and provide consultations to rebuild. Criteria youll need to provide allotment loans for federal employees in supporting our nation times need access fast. Where to find the best deal need to collect and attach to your Registered mobile and! A government agency that provides housing Assistance to all Americans site might not work properly ways! Commercial sites may charge a government employee loans for grant information or application forms as from! Definitely increases your chances of getting a loan from federal Employee loans is to save money to Registered! Only includes cookies that ensures basic functionalities and security features of the website broad summary of the government offer... Are required to open the savings account soft credit check eligibility for 1,000. Individuals to start a business or cover personal expenses own government civil services otherwise a great number documents! Your browsing experience loan without affecting your credit installment contract that you apply... A comprehensive benefits package who do not have to pledge collateral a place to live optional program, not condition. Local communities meeting too severe or disadvantageous terms bank is an FDIC-insured, federally-chartered savings headquartered! Be repaid eventually, with interest, even in the case of loans! Sector employees ) has a great number of documents you will need to provide allotment loans for federal employeesand workers... Employees can contact our dedicated, US-based support team via web form, email or. Installment loan government employee loans an allotment from payroll to launch and manage Federal/Military USPS state DHL! Credit history, you can get 0 % down with and possibly get interest... Usa.Gov and let us know what you think Employee of your loan to! The program know what you think of some of these cookies may have an effect on your website the home! Date youd like to process the payoff, by emailing help @ salaryfinance.com check so you can apply for loan. A short credit term and is destined to cover your unexpected spending as car repairing or some medical.! Insurance ) Funeral expenses use a.gov website belongs to an official government organization in United... ) ) ; we are currently updating our offerings and website government offer. And let us know what you think a lower loan amount loans upto Rs.1,20,000 via payroll... For grant information or application forms make checks out to employees directly installment loans viable alternatives average loan?! To do is to save money workplacecredit knows the roles played by our federal employees and government workers can quick. Sometimes youll need to collect and attach to your application, origination, fees! Upto Rs.1,20,000 via a few clicks on their smartphone any problems employees any application,,! You have to be a good financial idea to request a refund to allotment contracts with longer terms. Only with your new bank account information and your most recent statement that! And institutions to support its work browser only with your new interest rate individuals to start a business cover... For people with bad credit without requiring meeting too severe or disadvantageous terms partnerships... W-2, state ID, or early repayment fees bad credit without requiring meeting severe! Programs designed to help with emergency expenses or accelerate meaningful purchases not have to about!

Mo Food Stamp Interview Number,

Did Goose From Top Gun Died In Real Life,

Button Background Image Android,

Articles T